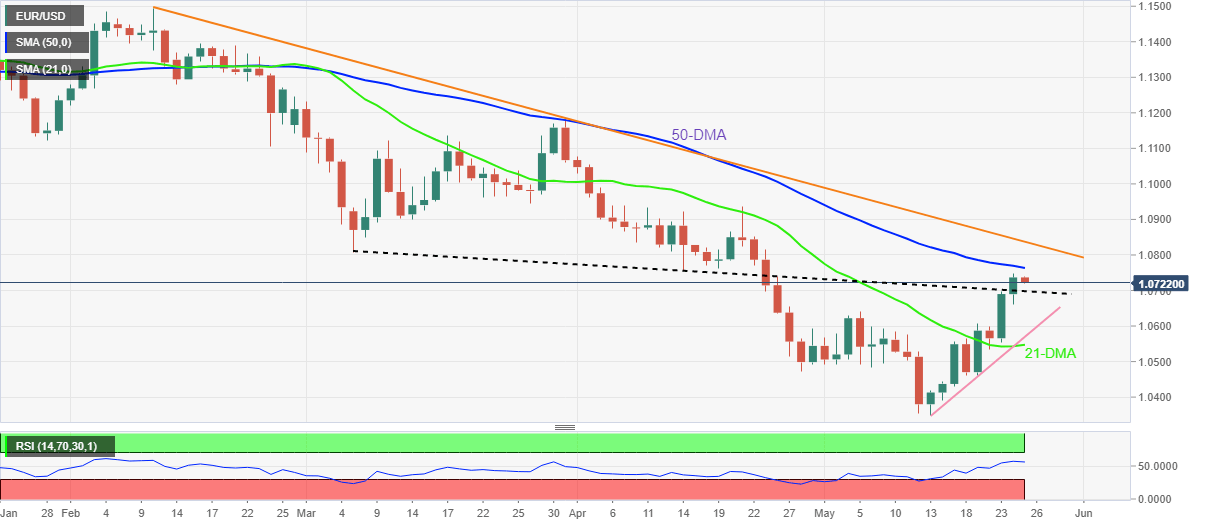

EUR/USD Price Analysis: Pullback from monthly top remains elusive above 1.0710

- EUR/USD snaps two-day uptrend near one-month high, renews intraday low.

- Previous resistance from March limits immediate downside, 50-DMA guards further advances.

- 21-DMA, descending trend line from February adds to the trading filters.

EUR/USD refreshes intraday low around 1.0720, consolidating weekly gains near the monthly peak. In doing so, the major currency pair prints weakness below the 50-DMA hurdle, as well as suggests further downside towards the 11-week-old resistance-turned-support line.

It’s worth noting, however, that a firmer RSI (14) and a clear upside break of the previous resistance line, around 1.0710, keep the pair buyers hopeful.

Even if the quote drops below 1.0710, the early month’s peak of 1.0641 and an upward sloping support line from May 13, close to 1.0570, will precede the 21-DMA level of 1.0547 to challenge the EUR/USD bears.

Alternatively, the 50-DMA level of 1.0765 challenges the short-term upside of the EUR/USD pair ahead of a downward sloping trend line from February, near 1.0840.

Should the quote rise past 1.0840, the late April swing high of 1.0936 and the 1.1000 psychological magnet will lure the EUR/USD bulls.

EUR/USD: Daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.