EUR/USD price analysis: Pair drifts lower amid bearish pressure

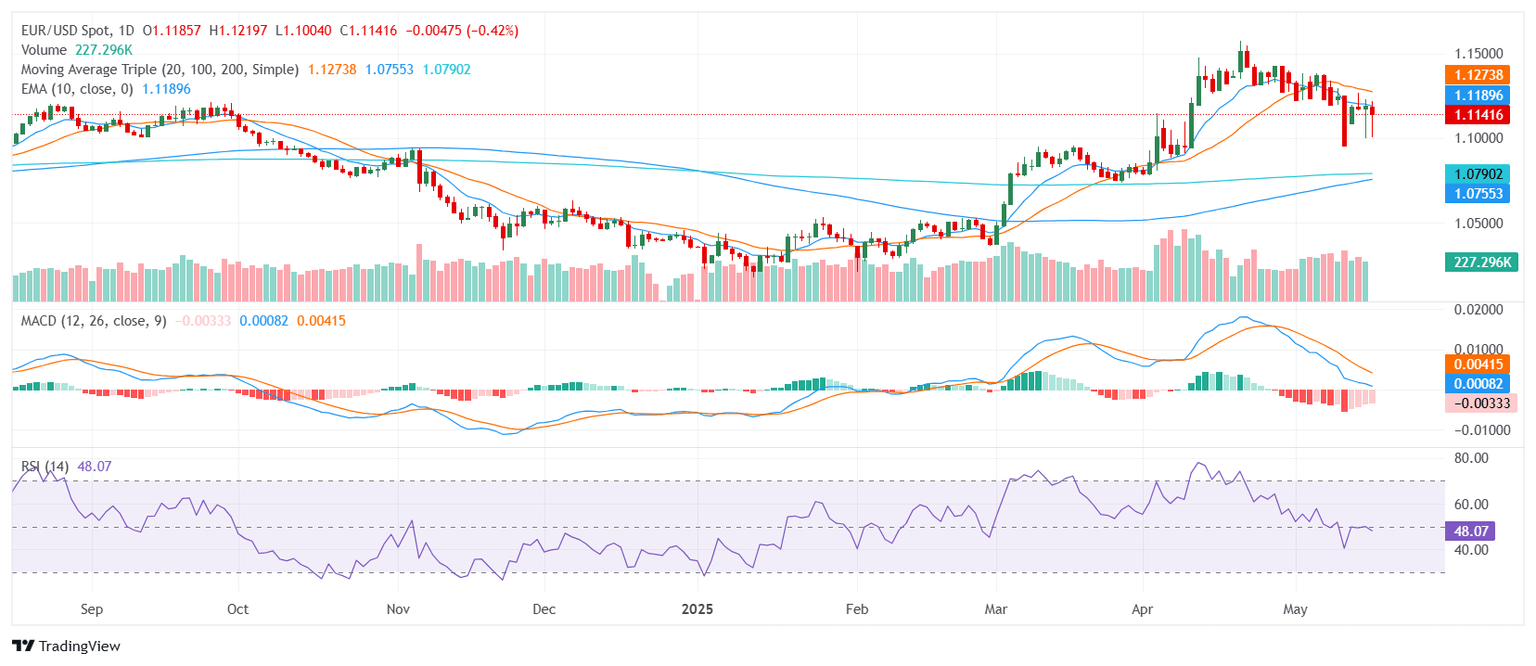

- EUR/USD trades near the 1.1100 zone with minor losses on Friday.

- The pair maintains a bearish outlook, supported by mixed technical signals.

- Key support is clustered below 1.1150, with resistance near 1.1200.

The EUR/USD pair is under modest selling pressure on Friday, moving near the lower end of its daily range around the 1.1100 zone. This positioning reflects a bearish tone, reinforced by a cluster of short-term technical indicators that favor downside momentum, despite some mixed signals from longer-term trends. As the European session wraps up, traders appear cautious, aligning with the broader risk-off sentiment in the market.

EUR/USD currently maintains a bearish bias, as highlighted by the alignment of its short-term moving averages. The 10-period Exponential Moving Average (EMA) and the 10-period Simple Moving Average (SMA) both point lower, signaling near-term selling pressure. The 20-day Simple Moving Average (SMA) also supports this bearish view, adding weight to the downside outlook. In contrast, the longer-term 100-day and 200-day SMAs indicate a more supportive backdrop, suggesting that the broader trend remains mixed.

(Several paragraphs of this article were removed on May 27 as they didn't comply with FXStreet's editorial standards regarding the use of Artificial Intelligence.)

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.