EUR/USD Price Analysis: Northward road looks bumpy despite bulls holding above 1.0600

- EUR/USD refresh intraday high during two-day uptrend, consolidates Wednesday’s big losses.

- Sustained break of 200-HMA, two-day-old bullish channel keeps buyers hopeful.

- Nearly overbought RSI conditions, sluggish MACD signals prod bulls.

- Convergence of 100-HMA, 61.8% Fibonacci retracement guards immediate upside.

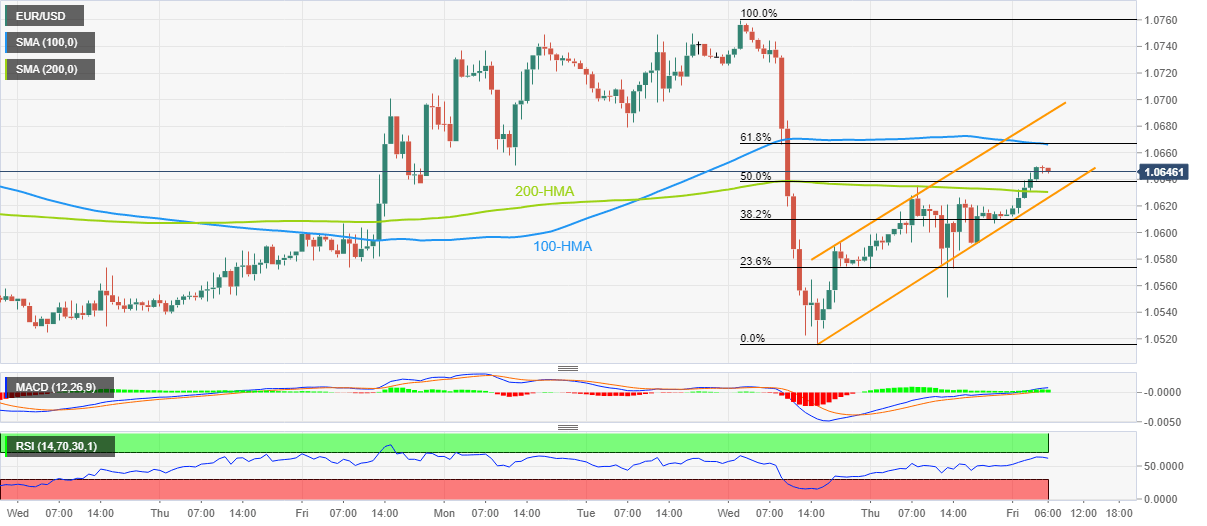

EUR/USD picks up bids to renew intraday top around 1.0650 as it portrays a two-day uptrend during the early hours of Friday. In doing so, the major currency pair cheers the upside break of the 200-Hour Moving Average (HMA) within a two-day-old ascending trend channel.

Although the 200-HMA breakout joins bullish channel formation to keep the EUR/USD bulls in the driver’s seat, the upside momentum appears to run out of steam as the RSI approaches the overbought territory while the MACD signals seem sluggish despite being bullish of late.

Apart from that, a convergence of the 100-HMA and 61.8% Fibonacci retracement level of the pair’s heavy fall on Wednesday, around 1.0665, appears a tough nut to crack for the bulls.

In a case where EUR/USD remains firmer past 1.0665, the aforementioned channel’s top line, near 1.0690 at the latest, precedes the monthly high surrounding 1.0760, marked on Wednesday, to challenge the quote’s further advances.

Meanwhile, the 200-HMA level surrounding 1.0630 restricts the immediate downside of the EUR/USD pair, a break of which highlights the stated channel’s bottom line, close to 1.0620, as the key support.

Should the EUR/USD pair drops below 1.0620, it defies the bullish chart formation and can drop to the monthly low marked on Wednesday around 1.0515.

EUR/USD: Hourly chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.