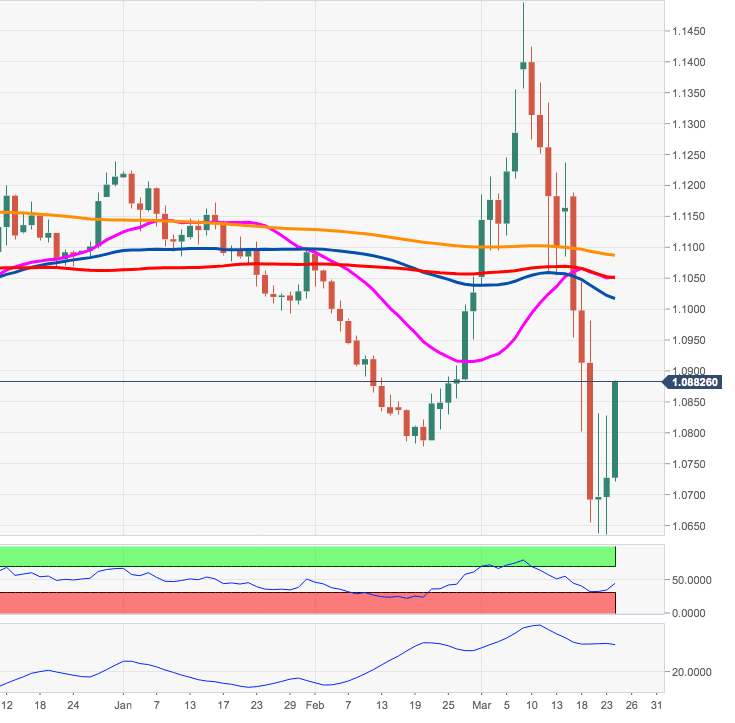

EUR/USD Price Analysis: Next target on the upside is the 1.0990 region

- EUR/USD extends the bounce to the vicinity of the 1.0900 mark.

- Next on the upside emerge January lows and the 10-day SMA at 1.1016.

EUR/USD is prolonging the recovery sustained by the renewed offered bias in the greenback.

Further upside thus remains well on the cards, with the immediate target emerging in the 1.0990 zone, where is located the January low.

If the buying pressure accelerates its pace, the 55-day SMA, today at 1.1016, should return to the investors’ radar.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.