EUR/USD Price Analysis: Next target emerges at 1.0180

- EUR/USD reclaims part of the ground lost on Tuesday’s sell-off.

- Further rebound should target the multi-month line near 1.180.

EUR/USD regains some poise and manages to trim part of the weekly pullback following Tuesday’s slump in the wake of the release of US inflation figures.

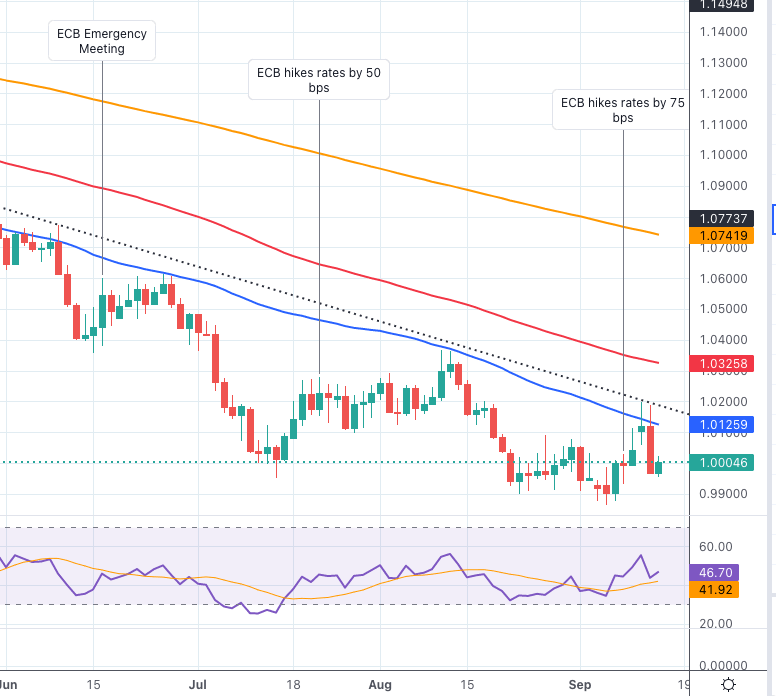

If the recovery picks up extra pace, then the interim hurdle comes at the 55-day SMA at 1.0125 prior to the key 7-month resistance line, today near 1.0180. A move beyond the latter is needed to mitigate the downside pressure and allow at the same time a visit to the interim 100-day SMA at 1.0325 prior to the more relevant August high at 1.0368 (August 10).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0741.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.