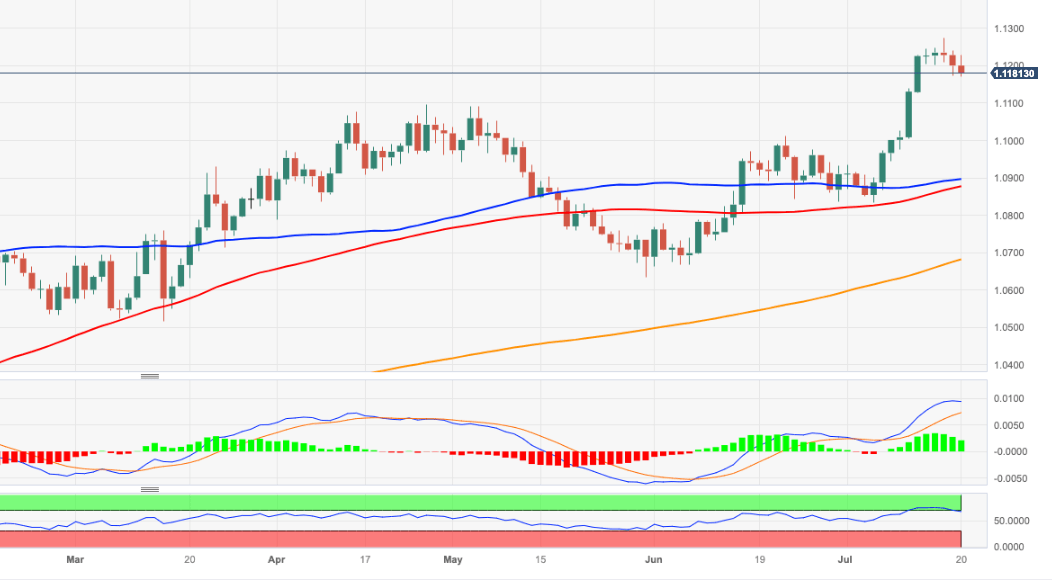

EUR/USD Price Analysis: Next support of note comes at 1.1000

- EUR/USD keeps correcting lower and revisits the 1.1170 zone.

- Further south emerges the next contention area at 1.1000.

EUR/USD leaves behind earlier gains and returns to the area of weekly lows near 1.1170 on Thursday.

While the continuation of the upside momentum appears favoured in the very near term, the ongoing corrective decline carries the potential to drag the pair to the 1.1000 neighbourhood, where a more solid contention is expected to emerge.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0680.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.