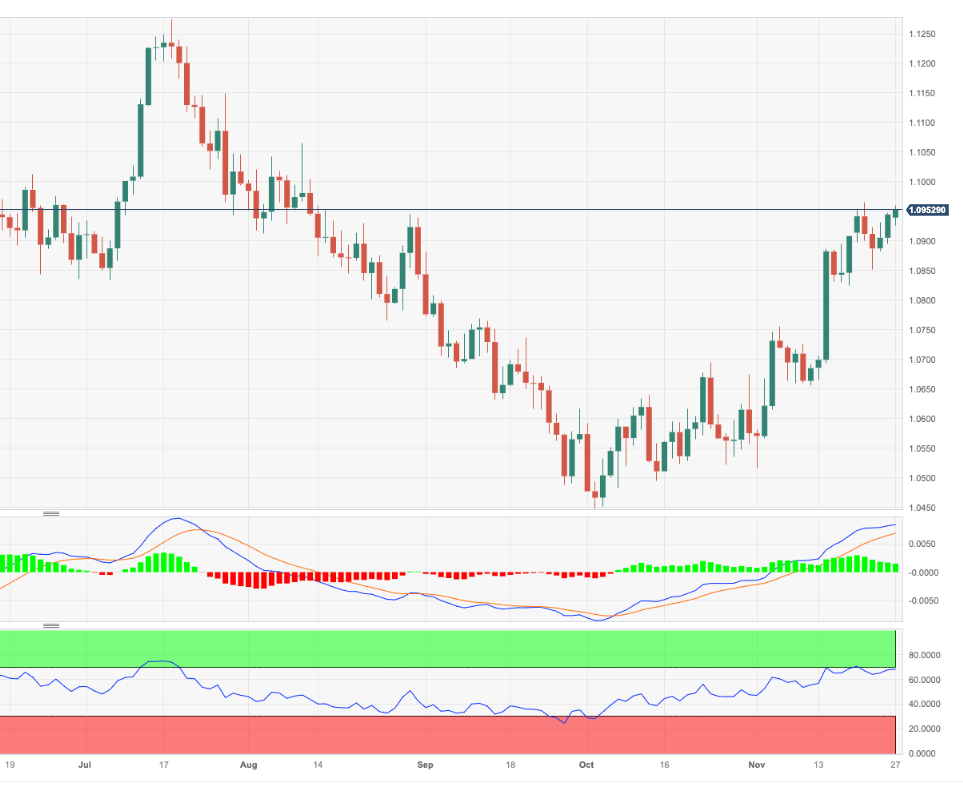

EUR/USD Price Analysis: Next on the upside comes 1.1000

- EUR/USD extends the bullish move to the 1.0960 zone.

- Extra advances could revisit the 1.1000 threshold.

EUR/USD climbs for the third session in a row and revisits the 1.0960 zone, or monthly highs, on Monday.

The continuation of the upward bias could see the psychological threshold of 1.1000 revisited ahead of the August top of 1.1064 (August 10).

So far, while above the significant 200-day SMA, today at 1.0810, the pair’s outlook should remain constructive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.