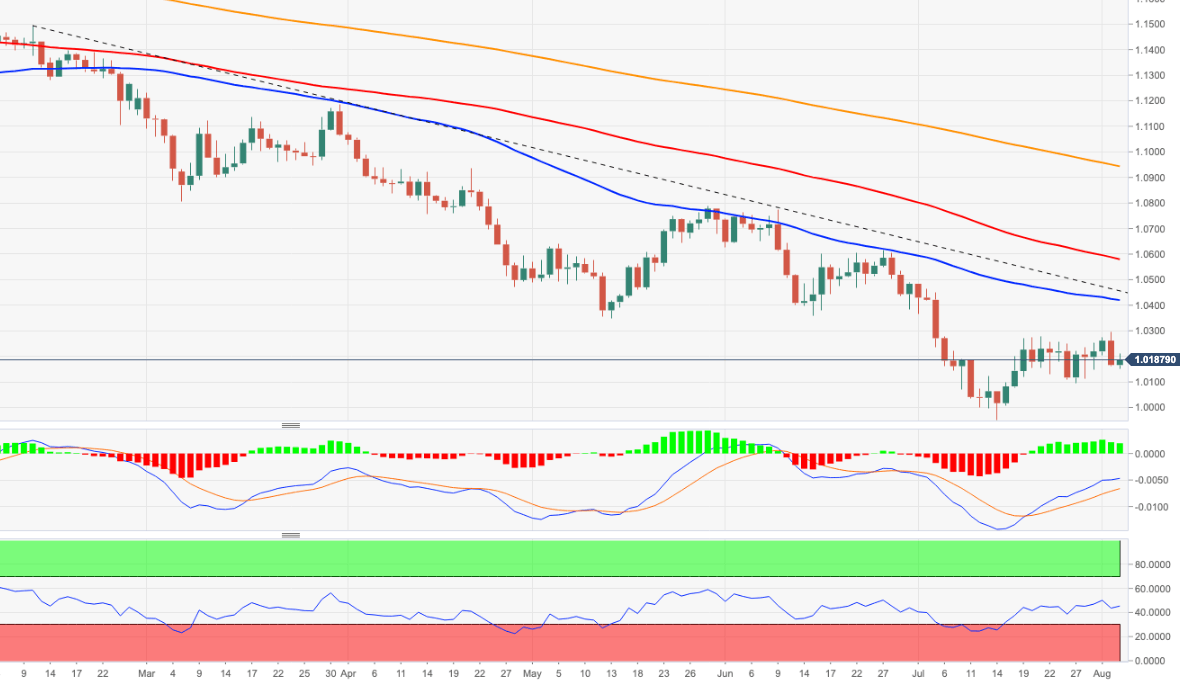

EUR/USD Price Analysis: Next on the upside comes 1.0300

- EUR/USD resumes the upside and advances above 1.0200.

- The next target emerges at the August top near 1.0300.

EUR/USD regains buying interest and reclaims part of the ground lost following Tuesday’s sell-off to the 1.0160 zone.

The continuation of the recovery is predicted to target the August high at 1.0293 (August 2). Above the latter spot could accelerate its losses to the next hurdle at the 55-day SMA, today at 1.0417.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0941.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.