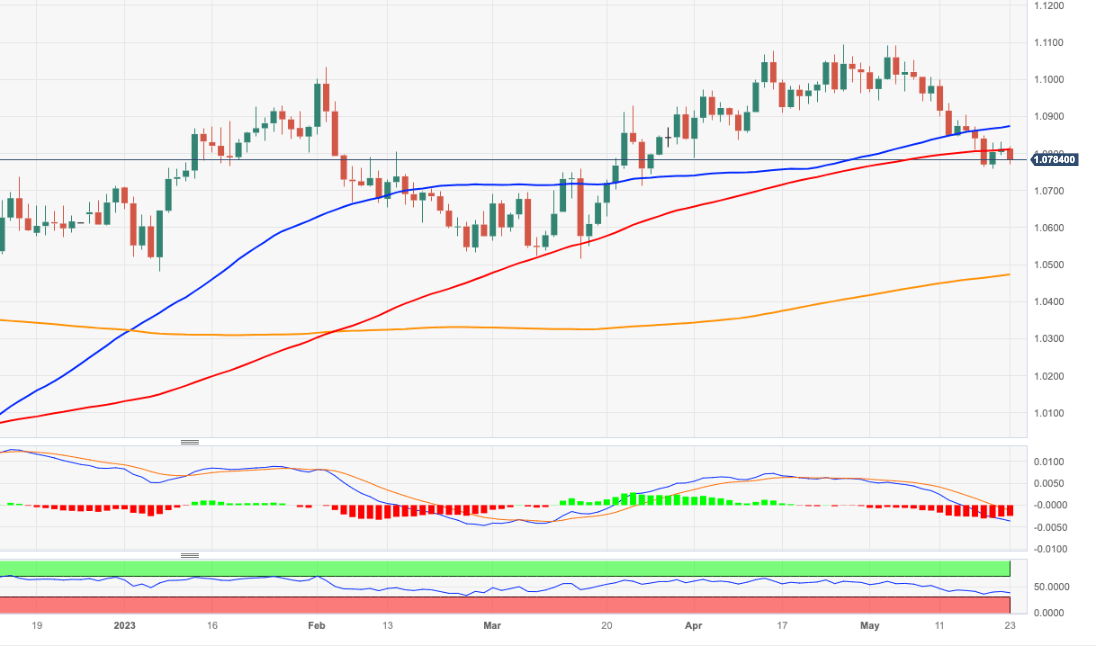

EUR/USD Price Analysis: Next on the downside comes 1.0760

- EUR/USD fails to extend the breakout of 1.0800 on Tuesday.

- The corrective decline could revisit monthly lows near 1.0760.

EUR/USD faces some downside pressure and breaches the key support of 1.0800 the figure on Tuesday.

The loss of upside traction could now force the pair to put the May low near 1.0760 to the test in the short-term horizon. Extra pullbacks could see the minor support level at 1.0712 (March 24) retested.

A deeper decline to the March bottom of 1.0516 (March 15), in the meantime, is not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0471.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.