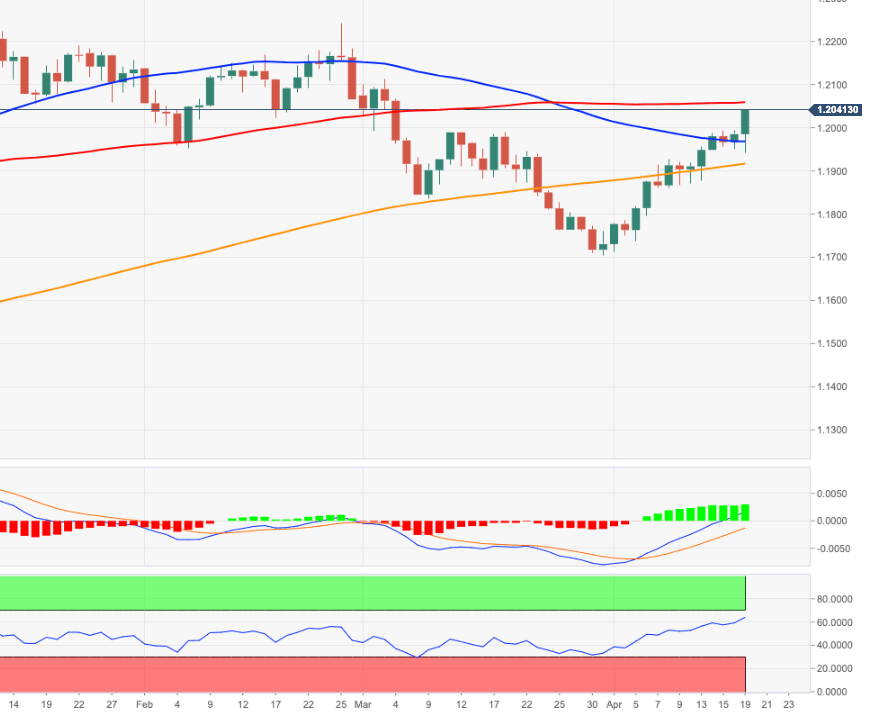

EUR/USD Price Analysis: Immediately to the upside comes in 1.2050/64

- EUR/USD finally surpasses the key barrier at 1.20 the figure.

- Further north of 1.20 comes in the 100-day SMA around 1.2050.

EUR/USD starts the week on a strong note and finally manages to advance further north of the psychological 1.2000 yardstick.

The firm buying pressure is expected to meet the next interim hurdle in the 1.2050/64 band, where converge the 100-day SMA and a Fibo retracement (of the November-January rally).

Above the latter the focus of attention is forecast to shift to the February peaks around 1.2240.

Above the 200-day SMA (1.1906) the stance for EUR/USD is predicted to remain positive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.