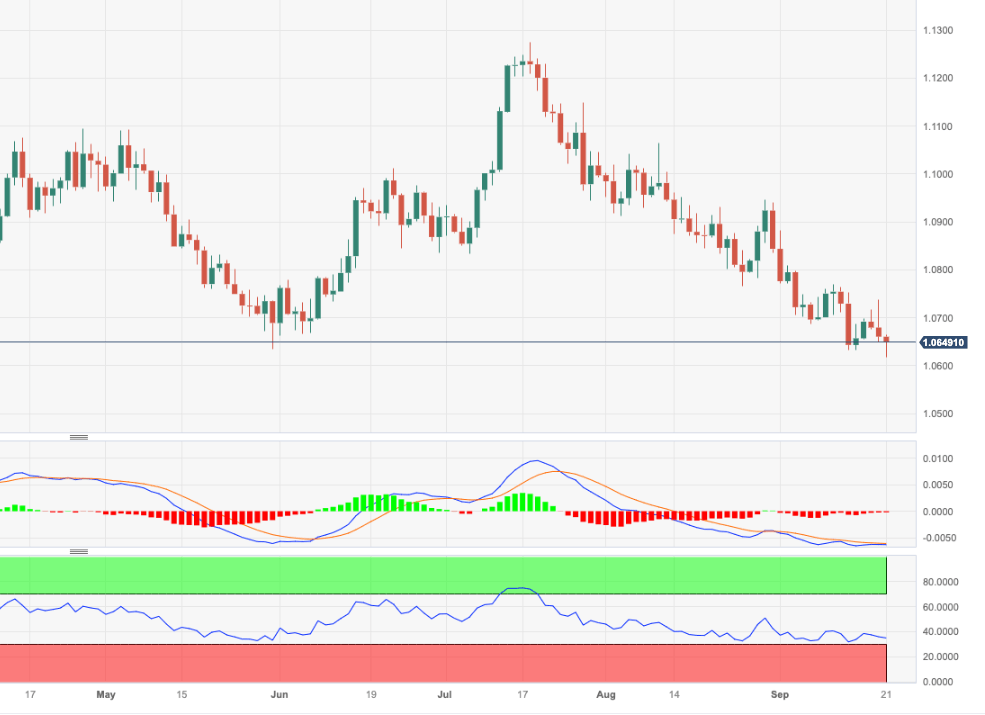

EUR/USD Price Analysis: Further south emerges the March low at 1.0516

- EUR/USD slips back to the 1.0615 region, reaching new six-month lows.

- Extra losses should meet the March low of around 1.0516.

EUR/USD retreats for the third session in a row and prints fresh lows around 1.0615 on Thursday.

If the pair breaches this level in the short-term horizon, it could then open the door to a potential retracement to the March low of 1.0516 (Mar 8), which is the last defence ahead of an assault on the 2023 low at 1.0481 (January 6).

While below the key 200-day SMA at 1.0828, the pair is likely to face extra weakness.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.