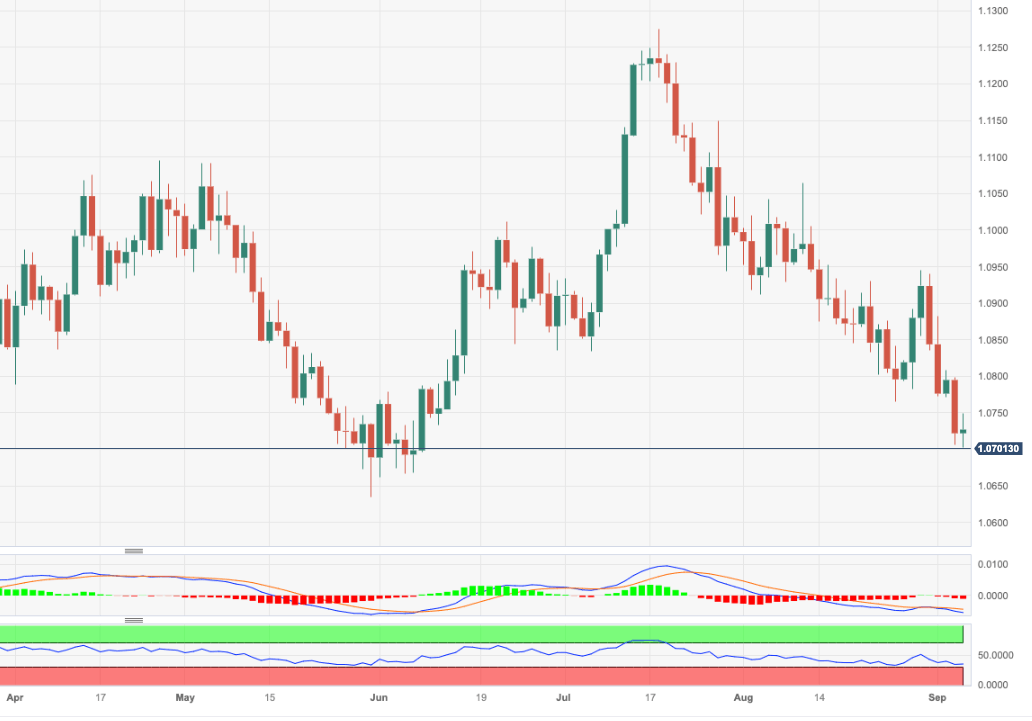

EUR/USD Price Analysis: Further losses appears in store near term

- EUR/USD breaks below the key 1.0700 support.

- Next on the downside aligns the May low in the 1.0630 zone.

EUR/USD retreats further and breaches the key support at 1.0700 the figure on Thursday.

The underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, the pair could now embark on a probable visit to the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0821.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.