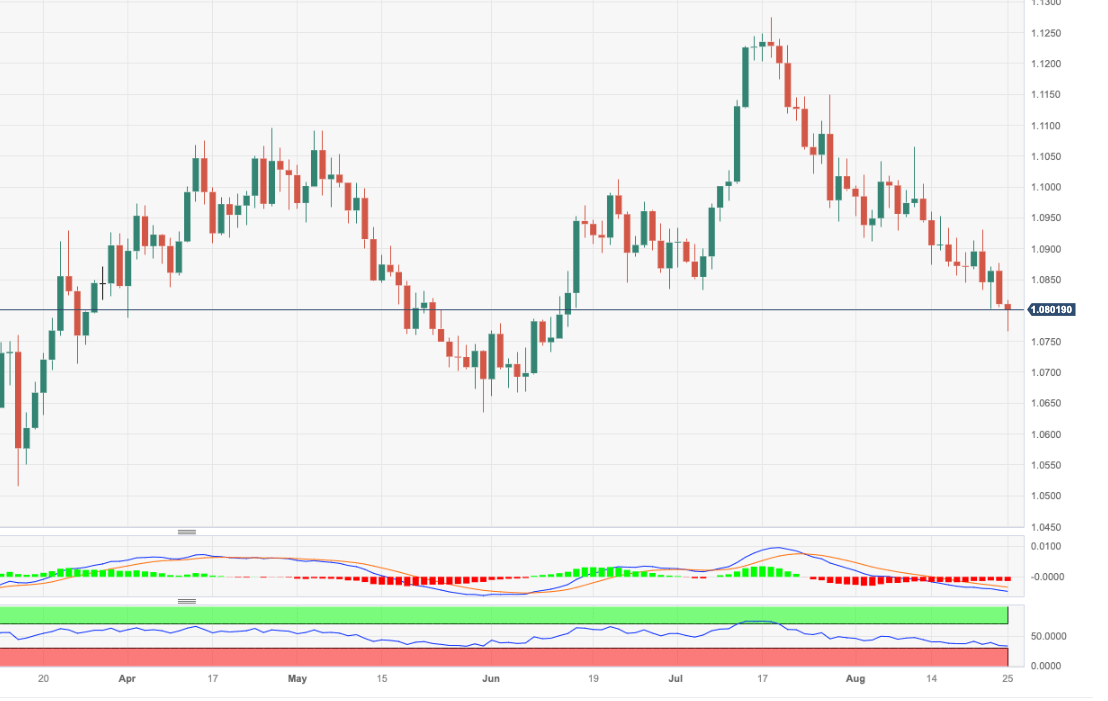

EUR/USD Price Analysis: Extra losses likely below the 200-day SMA

- EUR/USD bounces off lows around the 1.0770 zone.

- The continuation of the decline could see 1.0630 retested.

EUR/USD remains under pressure and wobbles round 1.0800 after bottoming out in the 1.0770/65 band, or new monthly lows, earlier on Friday.

The loss of the August low favours extra losses to, initially, the May low of 1.0635 (May 31) prior to the 2023 low of 1.0481 seen in early January.

A drop below the 200-day SMA should keep extra pullbacks in store for the time being.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.