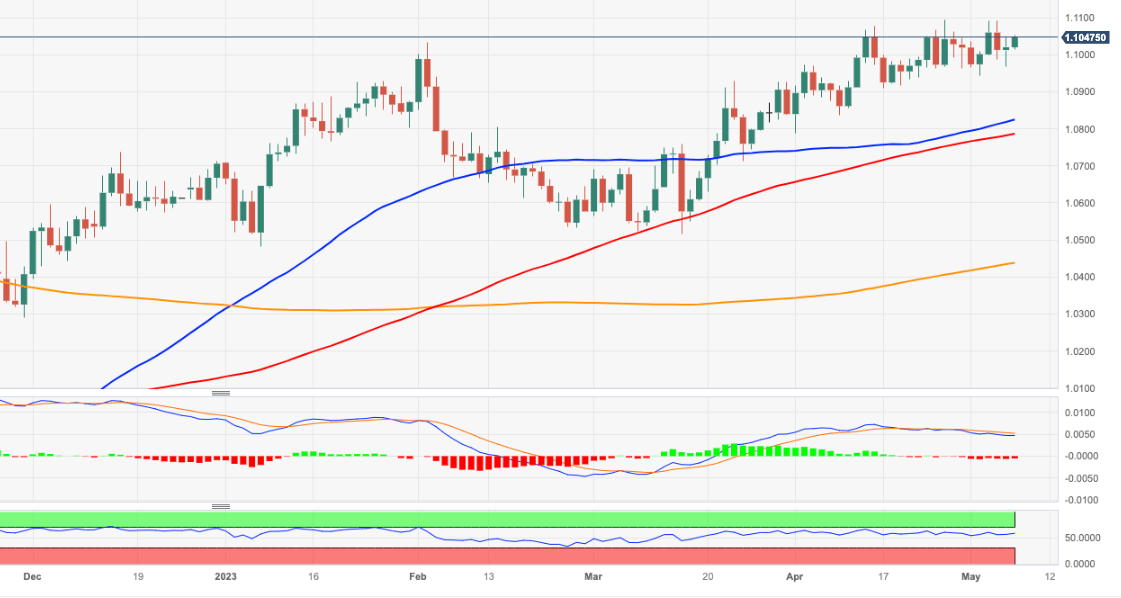

EUR/USD Price Analysis: Extra gains target the 2023 high near 1.1100

- EUR/USD extends Friday’s upside momentum to 1.1050.

- Further strength could see the YTD high near 1.1100 revisited.

EUR/USD maintains the bid bias well in place and revisits the mid-1.1000s at the beginning of the week.

Further recovery appears on the table for the time being. The surpass of with the 2023 peak at 1.1095 (April 26) should encourage the pair to rapidly leave behind the round level at 1.1100 before embarking on a potential visit to the weekly high at 1.1184 (March 21 2022)

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0436.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.