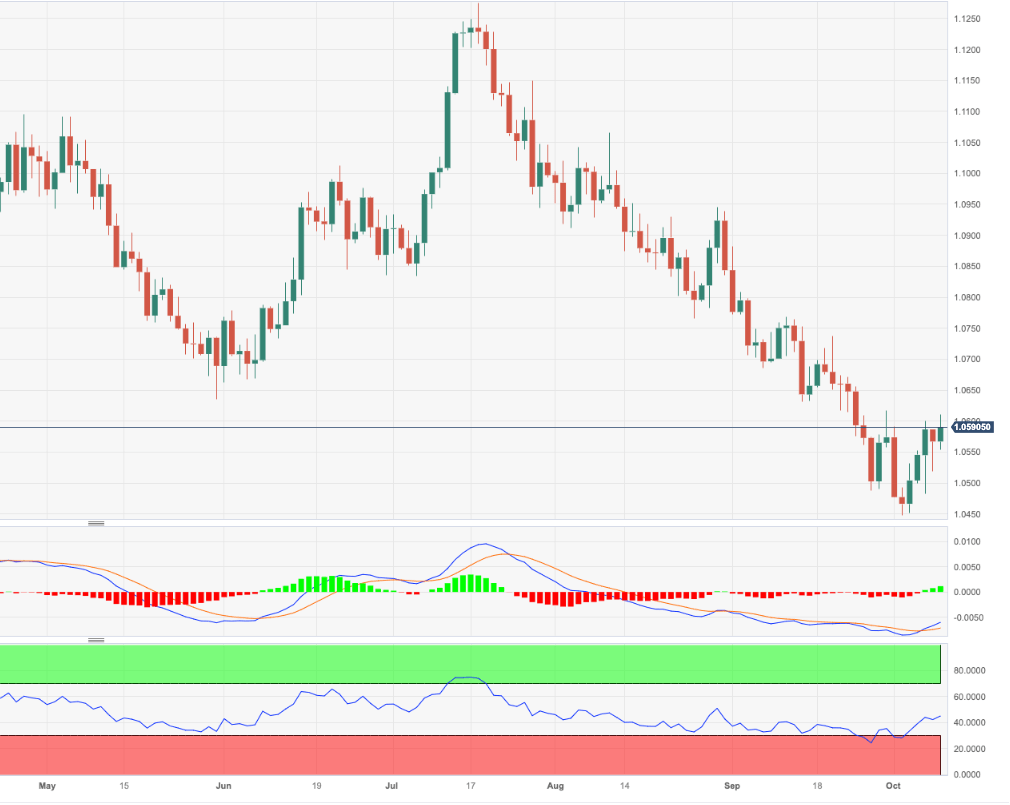

EUR/USD Price Analysis: Extra gains need to clear 1.0620

- EUR/USD revisits the area above 1.0600 once again on Tuesday.

- The continuation of the rebound should target the 1.0620 area.

EUR/USD regains composure following Monday’s pessimism and breaks above the 1.0600 hurdle.

In case bulls regain the initiative, the pair should initially retarget the minor barrier at 1.0617 (September 29) ahead of the weekly peak of 1.0767 (September 12). On the flip side, if bears regain the upper hand, the pair could slip back to the area of yearly lows around 1.0450 (October 3).

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA, today at 1.0823.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.