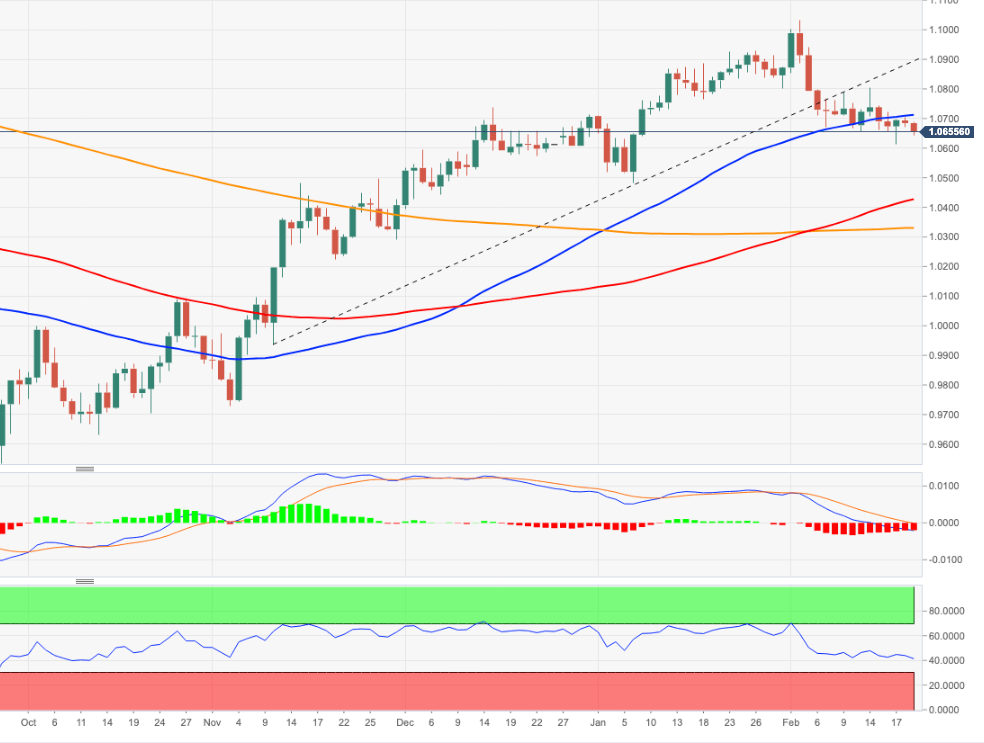

EUR/USD Price Analysis: Extra consolidation appears in store near term

- EUR/USD adds to Monday’s pullback, always below 1.0700.

- Further weakness could retest the monthly low near 1.0610.

EUR/USD keeps the side-lined theme well in place in the lower end of the range in the sub-1.0700 region so far on Tuesday.

If bears push harder, then the pair could confront the next support of note at the February low at 1.0612 (February 17). The breakdown of this level could prompt a potential test of the 2023 low at 1.0481 (January 6) to start shaping up in the short-term horizon.

So far, the bearish sentiment is expected to persist as long as the 3-month resistance line, today just beyond 1.0900 the figure, caps the upside.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0328.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.