EUR/USD Price Analysis: Bears struggle below 1.1700 amid oversold RSI

- EUR/USD bears take a breather around fresh monthly low.

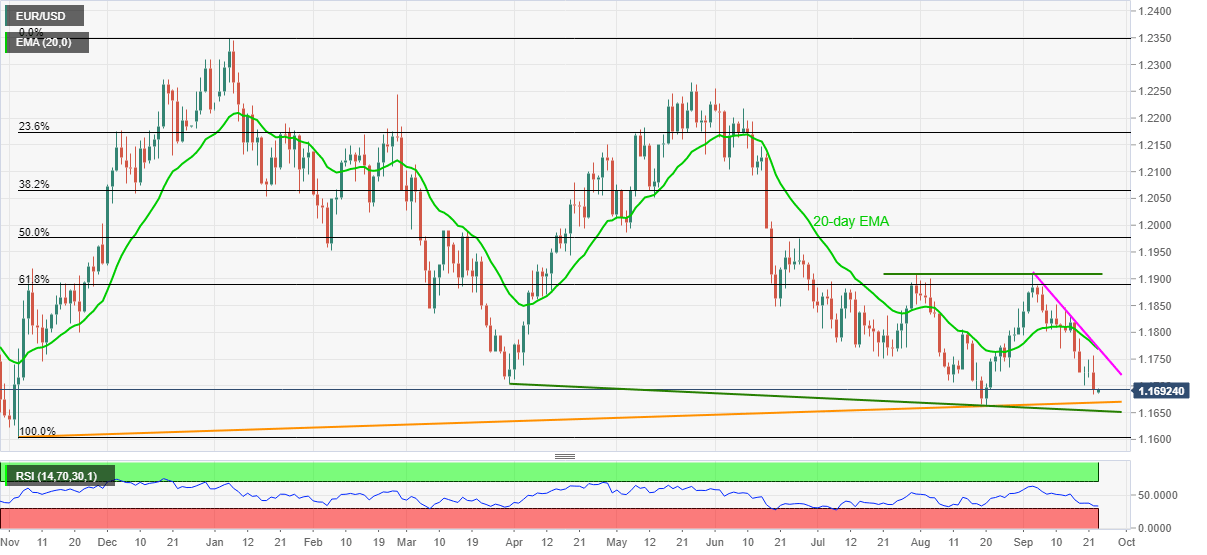

- Oversold RSI, multi-day-old support lines challenge further downside.

- 20-day EMA, monthly resistance line will gain attention during corrective pullback.

EUR/USD seesaws around the monthly low near 1.1690 amid a sluggish start to Thursday’s Asian session.

In doing so, the currency major pair struggles to extend the Fed-led fall as RSI conditions turn oversold. However, the quote remains below the short-term key resistance confluence including 20-day EMA and a descending trend line from September 03, which in turn keeps bears hopeful.

Hence, recovery moves remain elusive below 1.1770, a break of which will aim for the 1.1830 resistance and 61.8% Fibonacci retracement (Fibo.) of November 2020 to January 2021 upside, near 1.1890.

Though, any further upside needs validation from the double tops around 1.1910.

Meanwhile, a 10-month-long rising support line, near 1.1670, may challenge the quote’s short-term weakness ahead of a downward sloping trend line from March close to 1.1650.

Even if the EUR/USD bears refrain from stepping back from 1.1650, November 2020 bottom near 1.1600 will be the key level to watch.

EUR/USD: Daily chart

Trend: Short-covering moves expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.