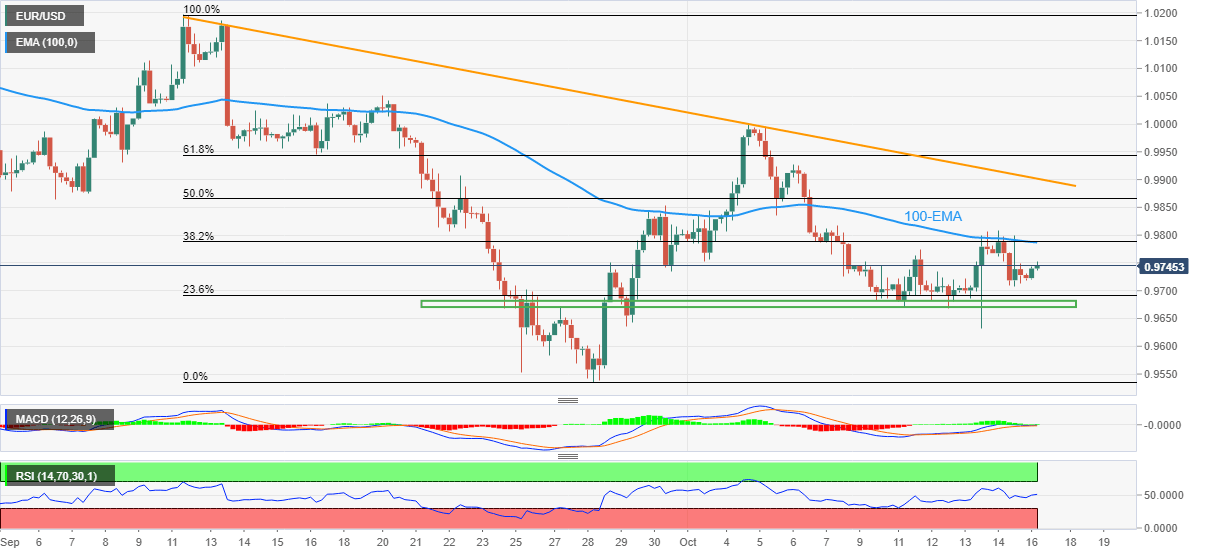

EUR/USD Price Analysis: Approaches 0.9790 resistance confluence

- EUR/USD picks up bids to reverse previous pullback form 100-EMA.

- 38.2% Fibonacci retracement level adds strength to the upside filter.

- Three-week-old horizontal support zone restricts immediate downside.

EUR/USD remains mildly bid around 0.9750 as it consolidates losses made during the last two weeks during early Monday. In doing so, the major currency pair jumps back towards a convergence of the 100-EMA and 38.2% Fibonacci retracement level of the September 12-27 downside.

Given the recently firmer RSI and sluggish MACD, the quote is likely to keep the latest rebound toward the 0.9790 hurdle.

However, the quote’s further upside appears difficult as the 50% Fibonacci retracement level and the monthly resistance line, respectively around 0.9865 and 0.9900, could challenge the EUR/USD bulls.

Also acting as the key resistance is the 61.8% Fibonacci retracement, also known as the golden ratio, around 0.9945, as well as the 1.0000 parity level.

Meanwhile, EUR/USD sellers will have to conquer the aforementioned horizontal support around 0.9680-70 to retake control.

Following that, the latest multi-year low of 0.9535 will regain the market’s attention before directing the bears towards the September 2001 peak near 0.9330.

To sum up, EUR/USD is likely to witness further upside but the bullish trend is still out of the sight.

EUR/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.