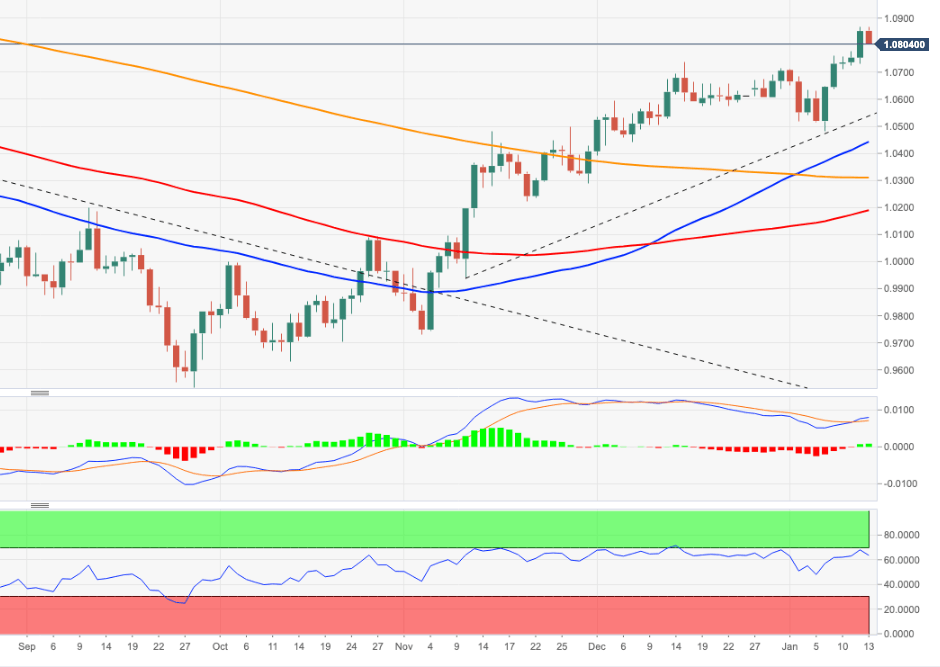

EUR/USD Price Analysis: A test of 1.0900 remains well in place

- EUR/USD sees its recent strong advance momentarily halted.

- The resumption of the bullish bias should target the 1.0900 level.

EUR/USD comes under pressure soon after hitting fresh 9-month peaks around 1.0870 on Friday.

Despite the ongoing knee-jerk, bulls remain well in control of the mood around the pair for the time being. Against that, further north of the so far YTD high at 1.0867 (January 13) should appear the round level at 1.0900 in the short-term horizon.

Furthermore, while above the short-term support line near 1.0550, the pair should maintain its bullish outlook.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0308.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.