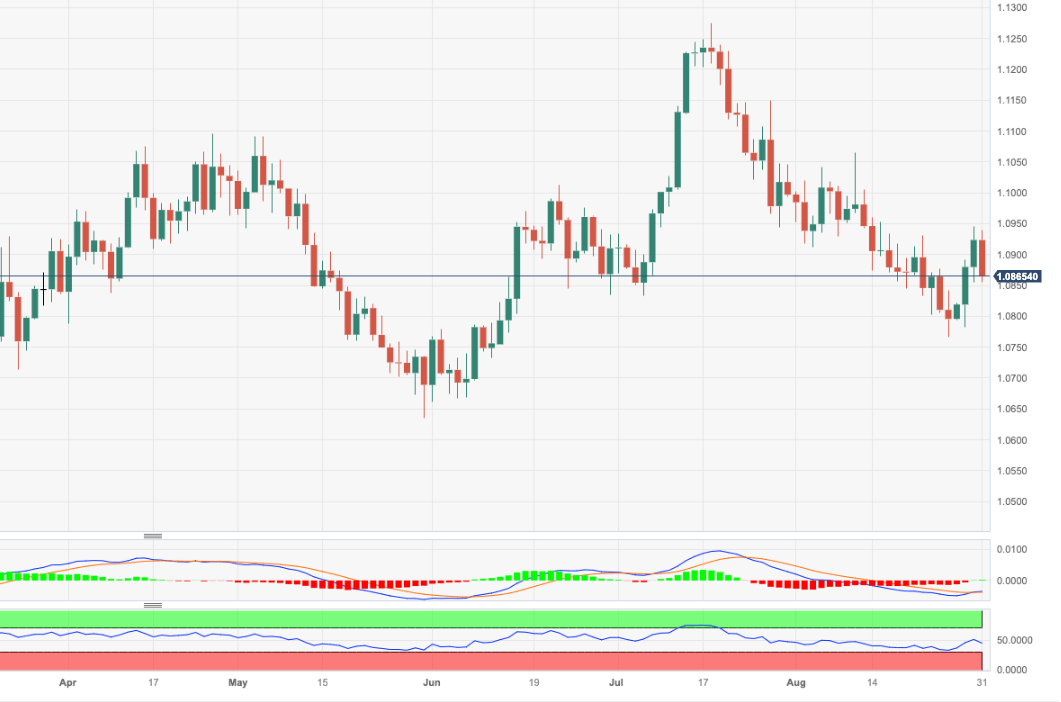

EUR/USD Price Analysis: A drop to the 200-day SMA is not ruled out

- EUR/USD sharply reverses part of the recent three-day advance.

- Next on the downside comes the 200-day SMA (1.0812).

EUR/USD faces strong headwinds and slips back to the 1.0860 zone on Thursday following tops near 1.0950 recorded in the previous session.

Despite the daily knee-jerk, the pair’s current momentum seems to be favouring the continuation of the march north for the time being. That said, there is a temporary hurdle at the 55-day SMA at 1.0968, which precedes the psychological 1.1000 mark and the August top of 1.1064 (August 10).

In case losses gather extra impulse, a pullback to the 200-day SMA, today at 1.0812, should not be ruled out.

In the meantime, the pair is likely to keep the bullish outlook unchanged while above the 200-day SMA.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.