EUR/USD Price Analysis: Bulls eye a break of key daily resistance

- EUR/USD bulls are in the market and eye a break of 1.0830.

- All now depends on the Fed ahead of the ECB late rin the week.

EUR/USD popped and dropped on Tuesday after hitting a 3-week high. A weaker dollar Tuesday was supportive of the euro but there was a turnaround when traders took a second inspection of the US inflation story. Core CPI remains sticky. However, central bank divergence remains positive for EUR/USD on the prospects for the Fed to pause raising interest rates on Wednesday this week while the ECB continues to raise interest rates.

However, the technical picture is clouded as follows:

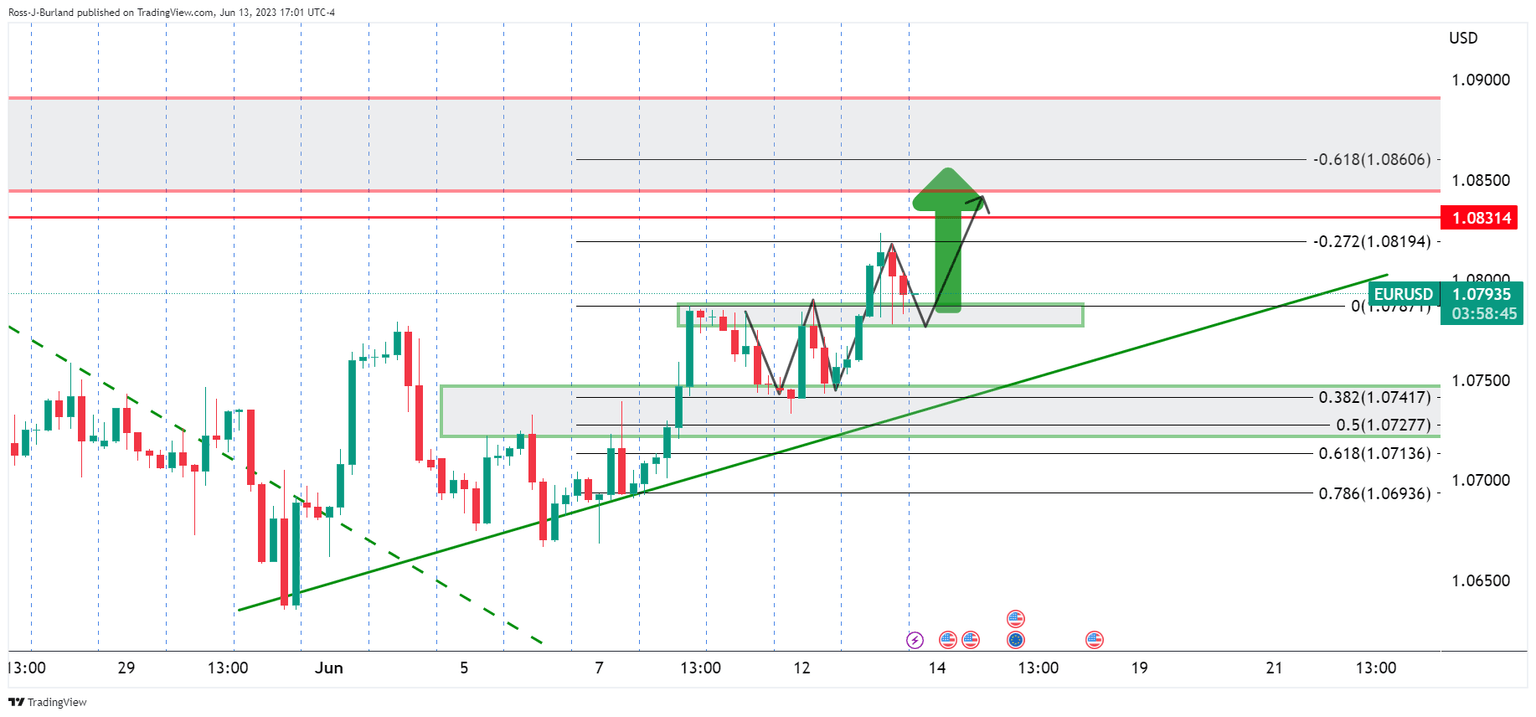

EUR/USD daily charts

The price is on the backside of the dominant bullish trend. This leaves a bearish bias on the daily charts. However, there are prospects of a meanwhile move higher as follows:

A move above 1.0830 opens the risk of a prolonged move higher for the coming days.

EUR/USD H4 chart

The 4-hour chart sees the price supported at the neckline of the W-formation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.