EUR/USD plummets on Trump's landslide victory, Fed policy takes center stage

- EUR/USD is hit badly with Trump’s victory in the US presidential election.

- The Fed is expected to cut interest rates again on Thursday but by a lower size of 25 bps.

- The Euro underperforms across the board as concerns over Eurozone economic growth have deepened.

EUR/USD nosedives to near 1.0700 in Wednesday’s North American session, the lowest level in over four months. The major currency pair hits badly as Republican candidate Donald Trump takes the Senate from Democrats after gaining an unconquered lead in key battleground states, according to The Associated Press. The agency shows that Trump has won over 270 seats, which is necessary to form the government.

Trump's victory is expected to keep the US Dollar (USD) on the front foot. At the time of writing. the US Dollar Index (DXY), which gauges Greenback’s value against six major currencies, surges to 105.30. Market action clearly shows that Trump’s victory is favorable for the US Dollar, which was already anticipated as the Republican candidate vowed to hike tariffs on imports and lower corporate taxes. A scenario that will boost overall business activity and labor demand and escalate inflationary pressures.

However, the plot is unfavorable for currencies of economies like the Eurozone, the United Kingdom (UK), China, and Canada, which are major trading partners of the United States (US). Trump’s protectionist policies will directly impact the export sector of the above-mentioned economies, which will boost the risks of an economic downturn.

Daily digest market movers: EUR/USD weakens Euro's weak performance and firm US Dollar

- EUR/USD faces severe selling pressure due to the US Dollar’s outperformance and the Euro’s (EUR) sharp depreciation against other major currencies. The outlook of the Euro has weakened as market participants expect that the implementation of Trump’s protectionist policies will significantly damage European economic growth.

- According to the Dutch bank, Trump's tariffs would shave approximately 1.5 percentage points off European growth, translating to a potential €260 billion economic loss based on Europe's estimated 2024 GDP of €17.4 trillion.

- Should Europe's growth falter under Trump's tariffs, the European Central Bank (ECB) may be compelled to respond aggressively, slashing rates to near zero by 2025, according to Euronews.

- Trump’s victory would likely force the ECB to cut its Deposit Facility Rate by a larger-than-usual size of 50 bps in its next monetary policy meeting in December. This would be the fourth interest rate cut by the ECB this year.

- Going forward, investors will also focus on the Federal Reserve’s (Fed) monetary policy decision, which will be announced on Thursday. According to the CME FedWatch tool, traders have priced in a 25-basis point (bps) interest rate cut, pushing rates lower to the 4.50%-4.75% range. This would be the second interest rate cut by the Fed in a row. However, the rate cut size will be lower than the 50 bps announced in the September meeting.

- Investors will also focus on Fed Chair Jerome Powell’s press conference to get cues about the impact of Trump’s victory on the interest rate path and the inflation outlook.

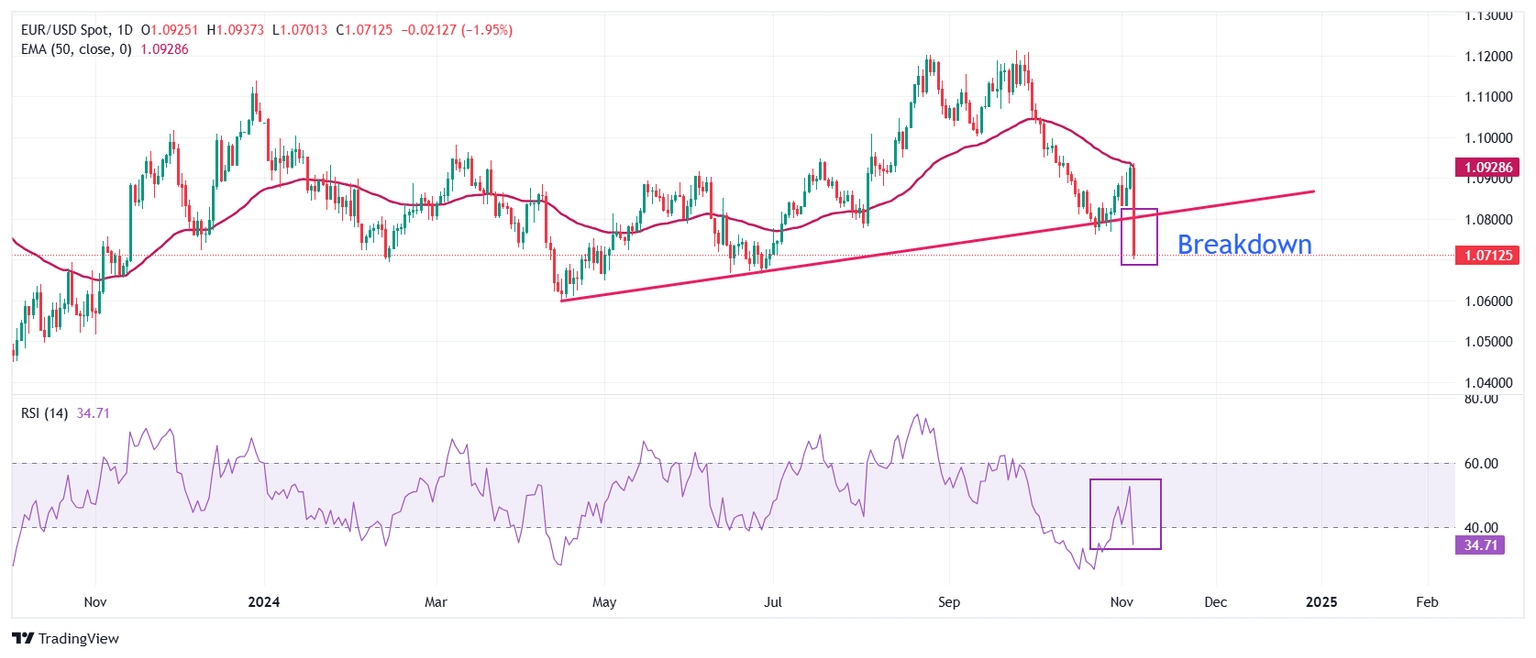

Technical Analysis: EUR/USD declines toward 1.0600

EUR/USD slides swiftly to near the key support of 1.0700. The outlook of the major currency pair weakens as it breaks below an upward-sloping trendline around 1.0750, which is plotted from the April 16 low at around 1.0600

The declining 50-day Exponential Moving Average (EMA) near 1.0930 suggests a firm bearish trend.

Additionally, the 14-day Relative Strength Index (RSI) retreats below 40.00, suggesting a resumption of the bearish momentum.

Looking down, the shared currency pair could decline to the year-to-date (YTD) low of 1.0600. On the upside, the round-level resistance of 1.0800 will act as a key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.