EUR/USD hovers near recent lows with the Dollar buoyed ahead of US PMI figures

- The Euro has reversed previous gains and approaches two-week lows at 1.1450.

- Fears that Iran might retaliate after US attacks are likely to keep risk appetite subdued on Monday.

- Eurozone business activity remained steady in June against expectations of a moderate improvement.

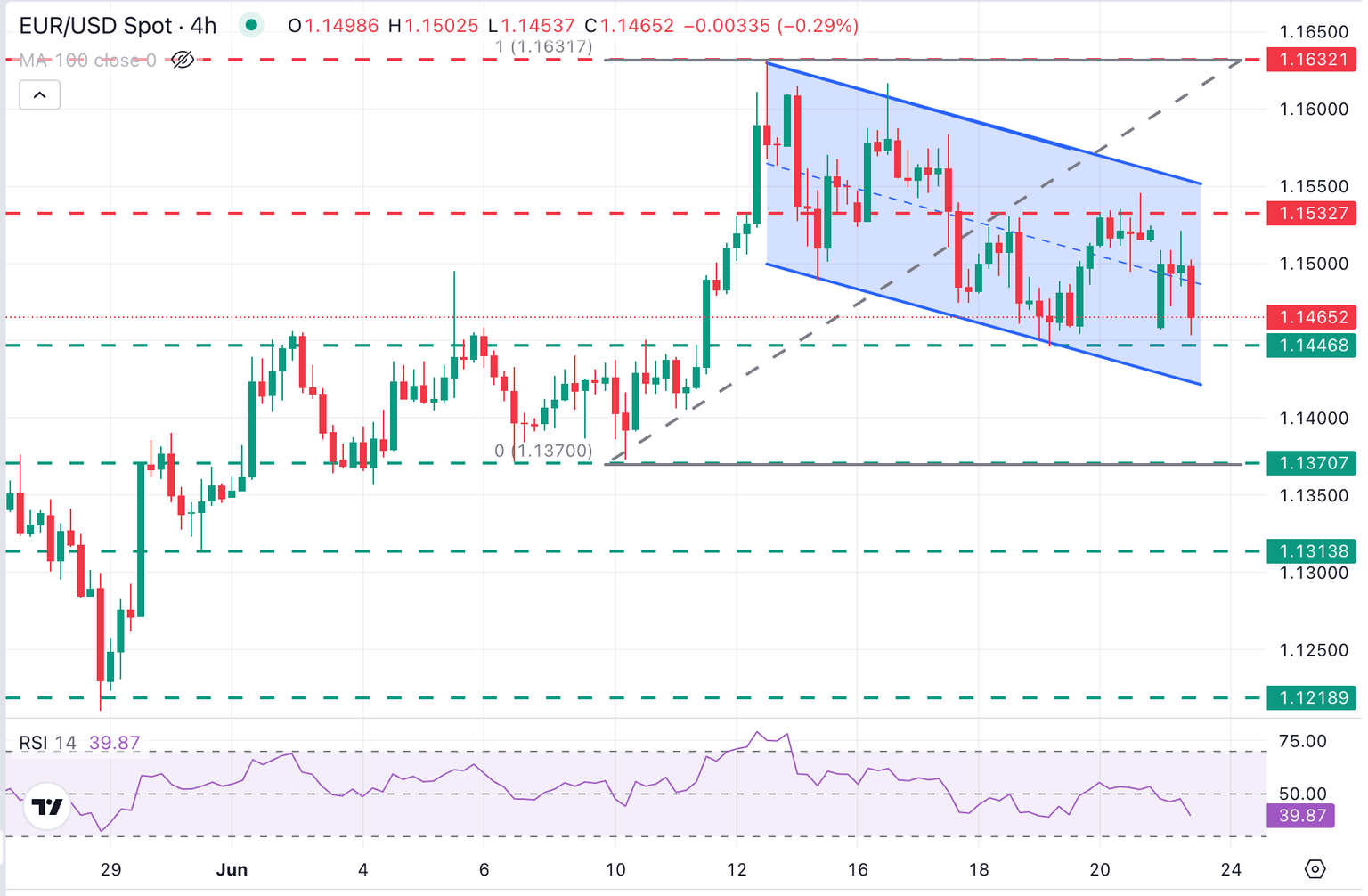

The EUR/USD has failed to return above the 1.1500 level on Monday and has turned lower, to reach levels right above the last two weeks' lows, at 1.1450. From a wider perspective, the pair remains within a descending channel from mid-June highs, with investors wary of risk and awaiting Iran's retaliation to the US attack.

The United States launched massive strikes on three key nuclear sites in Iran, including the underground facility of Fordow, which, according to US President Donald Trump, has devastated Iran's nuclear program. Further comments from Trump suggest that this has been a one-off action and that a wider escalation can be avoided if Tehran refrains from retaliation. The market reaction, so far, has been limited.

Iran's authorities have launched missiles at Israel, and its parliament approved the closure of the Strait of Hormuz, a key gateway to Oil transport, which might bring Crude prices to levels well beyond 100 per barrel. Iran has not attacked US interests in the region so far, but if this happens, it would be the trigger for a wider regional war.

In the macroeconomic data front, the Eurozone HCOB PMI figures revealed that business activity remained steady in June, despite hopes of a moderate improvement. The focus now is on the European Central Bank (ECB) President Christine Lagarde's introductory speech before the Committee of Economic and Monetary Affairs (ECON) of the European Parliament.

In the US, the preliminary June S&P Manufacturing and Services PMIs will be carefully analyzed to assess the momentum of the US economy, following a string of downbeat data over the previous two weeks.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | 0.22% | 0.68% | 0.28% | 0.82% | 1.05% | 0.10% | |

| EUR | 0.06% | 0.26% | 0.80% | 0.34% | 0.84% | 1.12% | 0.13% | |

| GBP | -0.22% | -0.26% | 0.59% | 0.08% | 0.58% | 0.86% | -0.13% | |

| JPY | -0.68% | -0.80% | -0.59% | -0.44% | 0.09% | 0.41% | -0.67% | |

| CAD | -0.28% | -0.34% | -0.08% | 0.44% | 0.59% | 0.77% | -0.21% | |

| AUD | -0.82% | -0.84% | -0.58% | -0.09% | -0.59% | 0.25% | -0.71% | |

| NZD | -1.05% | -1.12% | -0.86% | -0.41% | -0.77% | -0.25% | -0.98% | |

| CHF | -0.10% | -0.13% | 0.13% | 0.67% | 0.21% | 0.71% | 0.98% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Cautious markets keep the US Dollar steady

- The reaction to the US strike on Iran has been constrained so far, but market sentiment remains cautious with all eyes on the Middle East conflict. Trump's comments have been all but clarifying, as he first suggested that the weekend's strike was a one-off action to affirm shortly afterward that he is weighing a change of regime, an objective that might have repercussions well beyond Iran's borders.

- The Euro remains steady at previous ranges, but the cautious market is likely to keep upside attempts limited. Oil prices rallied to fresh five-month highs at the week's opening, and despite the later reversal, the increase of over 20% in prices in the last four weeks is adding a new strain to the Eurozone economy, as the region is a net Crude importer.

- Eurozone data Preliminary HCOB PMI figures revealed that business activity in the services sector remained steady with a 50.2 reading, and the same accounts for the manufacturing sector, with June's reading unchanged from the previous month's 49.4. The market consensus anticipated increases to 50.4 and 49.8, respectively.

- Somewhat later, the focus will shift to ECB President Lagarde, who will review the Eurozone's latest economic events and might reiterate the message delivered after the central bank's latest monetary policy meeting, suggesting that the ECB is close to its terminal rate.

- In the US, the preliminary S&P Global PMI figures are expected to show that economic activity weakened in both sectors, yet at levels still consistent with growth. The risk is of another disappointment that would heighten concerns about the US economy and might weigh on the US Dollar.

- On Friday, Federal Reserve Governor Christopher Waller opened a crack in Chairman Jerome Powell's hawkish stance, advocating for an interest rate cut in July, which boosted investors' optimism and increased negative pressure on the US Dollar. These comments have increased the interest in Powell's Semiannual Monetary Policy Report to Congress, due on Tuesday and Wednesday, where the central bank's chief will be questioned about plans to manage a challenging contest of higher inflation and slower growth. Investors will be looking for any dovish hints that will boost hopes of a rate cut in September, which is the market's safest bet.

EUR/USD remains on an extended correction from 1.1630 highs

EUR/USD has bounced up on Monday but remains trapped within the descending channel from mid-June highs, at 1.1630. Immediate resistance is at the 1.1535-1.1545 area, which capped upside attempts on June 18 and 20 and the top of the bearish channel, now at 1.1555.

A confirmation beyond these levels would suggest that the current correction is a bullish flag and increase positive momentum, shifting the focus towards the mentioned June 12 high at 1.1630. The flag's target is at the 127,2% Fibonacci extension of the June 10-12 rally, at 1.1700.

On the downside, immediate support is at 1.1445 (June 19 low) and the descending channel trendline support, now at 1.1420.

(This story was corrected on June 23 at 8:24 GMT to add the Eurozone preliminary PMI data, which was already released at the time of publication.)

(This story was corrected on June 23 at 09:42 GMT to say that the EUR/USD was trading within a bearish channel from June highs, and not from May highs as previously reported.)

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Next release: Mon Jun 23, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 51

Previous: 52

Source: S&P Global

Economic Indicator

S&P Global Services PMI

The S&P Global Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector. As the services sector dominates a large part of the economy, the Services PMI is an important indicator gauging the state of overall economic conditions. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for USD.

Read more.Next release: Mon Jun 23, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 52.9

Previous: 53.7

Source: S&P Global

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.