EUR/USD dives further on downbeat business climate data, a firmer USD

- The Euro extends losses below session lows at 1.1780 as German business sentiment deteriorates.

- A sour market sentiment is underpinning demand for the safe-haven USD on Wednesday.

- On Tuesday, Fed Chair Jerome Powell warned that further interest rate cuts are not guaranteed

EUR/USD is drifting lower from 1.1820 highs, trading at fresh session lows sub-1.1770 at the time of writing. A sour market sentiment and the release of weaker-than-expected business climate figures in Germany are weighing on the common currency, while the safe haven US Dollar maintains a firmer tone than in previous days.

The German IFO institute's Business Climate index has shown that the economic sentiment among German firms deteriorated against expectations in September. Companies consider the current economic situation slightly worse than in previous months and are less optimistic about their near-term expectations.

On Tuesday, the US flash Purchasing Managers Index (PMI) revealed that business activity slowed down for the second consecutive month in September, in line with expectations. The S&P Global's report suggested that tariffs are pushing costs higher, while a weak demand and fierce competition limit firms' ability to raise prices, which rose at their slowest pace since April.

Somewhat later, the Federal Reserve (Fed) Chairman, Jerome Powell, reiterated the bank's challenges to set the correct monetary policy to combat higher inflation risks without damaging the labor market further. Powell maintained his cautious stance on further monetary easing, but he failed to alter the market's view that the central bank will cut interest rates in each of the two remaining monetary policy meetings this year.

The economic calendar is lighter on Wednesday. The US August's New Home Sales and a speech from San Francisco Fed President, Mary Daly, will gather the market's attention during the American session.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.46% | 0.55% | 0.29% | -0.15% | 0.37% | 0.40% | |

| EUR | -0.54% | -0.08% | 0.02% | -0.25% | -0.69% | -0.16% | -0.14% | |

| GBP | -0.46% | 0.08% | 0.08% | -0.17% | -0.56% | -0.10% | -0.11% | |

| JPY | -0.55% | -0.02% | -0.08% | -0.28% | -0.69% | -0.26% | -0.18% | |

| CAD | -0.29% | 0.25% | 0.17% | 0.28% | -0.41% | 0.07% | 0.11% | |

| AUD | 0.15% | 0.69% | 0.56% | 0.69% | 0.41% | 0.53% | 0.55% | |

| NZD | -0.37% | 0.16% | 0.10% | 0.26% | -0.07% | -0.53% | 0.05% | |

| CHF | -0.40% | 0.14% | 0.11% | 0.18% | -0.11% | -0.55% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Risk aversion and weak data hurt the Euro

- Euro bears are gathering momentum, hit by the weak German data, while the cautious market sentiment supports the safe-haven US Dollar, which is one of the stronger performers on Wednesday.

- Data released on Wednesday revealed that the German Business Climate Index fell to 87.7 in September from 89.0 in August, against market expectations of an improvement to 89.3. Furthermore, the Index measuring investors' assessment of the current economic conditions deteriorated to 85.67 from 86.4, while the economic expectations gauge dropped to 89.7 from 91.6 in the previous month.

- On Tuesday, Preliminary PMI figures from the US revealed that services activity eased to 53.9 in September, from 54.5 in August, while the manufacturing activity slowed down to 52 from 53 in the previous month. The data meet the market's consensus in both cases.

- Fed Chair Powell highlighted the "challenging situation" ahead for the central bank's policymakers and warned that further rate cuts are not guaranteed, but investors paid little attention. The US Dollar dropped following his speech, Gold and Stocks hit fresh highs.

- Data from Europe showed an unexpected acceleration of service activity growth. The preliminary PMI rose to 51.4 against expectations of a steady 50.5 reading. Manufacturing activity, on the other hand, fell to 49.5 from 50.7, against expectations of a slight improvement to 50.9.

- Likewise, German Manufacturing PMI fell to 48.5 from 49.8 against expectations of an improvement to the 50.0 level. Services activity, on the other hand, accelerated to 52.5 from 49.3, beating expectations of a weaker improvement to 49.5.

- In France, the Manufacturing PMI dropped to a three-month low of 48.1, from 50.4 in August, well below the 50.2 anticipated by the market's consensus, while the services sector's activity accelerated its contraction, to 48.9 from 49.8 in the previous month, well below the 49.6 reading expected by the market.

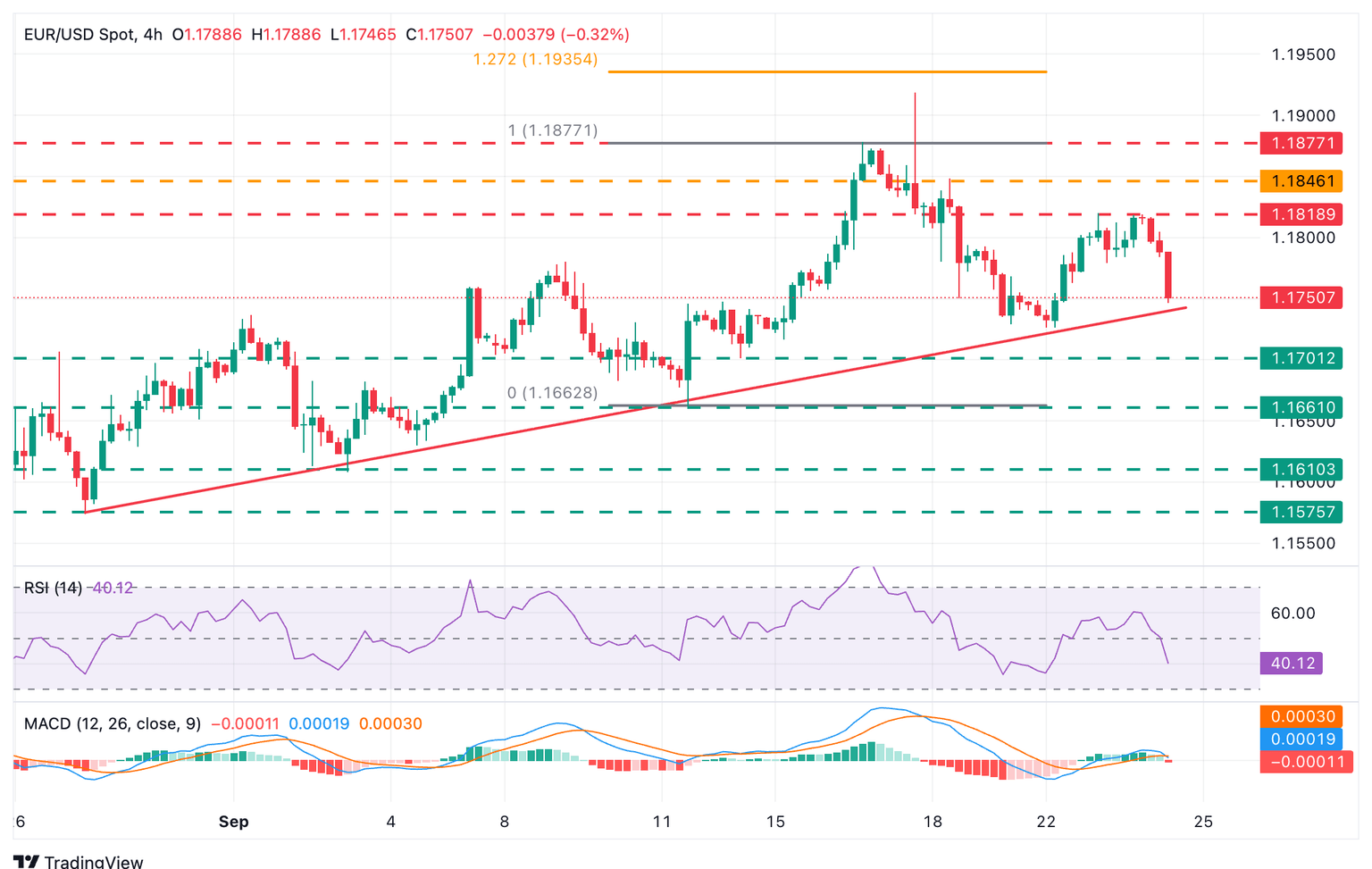

Technical Analysis: EUR/USD is approaching key support at 1.1740

EUR/USD is under a strong bearish momentum after breaching 1.1780 support, with bears eyeing the trendline support from September 2 lows,near 1.1740. The Relative Strength Index (RSI) has dipped below the 50 level, and the Moving Average Convergence Divergence (MACD) crossed below the signal level, confirming that sellers have taken control.

A confirmation below the mentioned 1.1740 trendline opens the path towards the September 22 low at 1.1730 and the September 12 low, near 1.1700. To the upside, Tuesday's high at 1.1820 has been capping upside attempts this week. Above here, the next targets are the September 18 high, near 1.1850, and the September 16 high at 1.1878.

Economic Indicator

IFO – Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).

Read more.Last release: Wed Sep 24, 2025 08:00

Frequency: Monthly

Actual: 87.7

Consensus: 89.3

Previous: 89

Source: IFO Institute

Economic Indicator

IFO – Expectations

The IFO Expectations released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations for the next six months, where firms rate the future outlook as better, same, or worse. An optimistic view of those 7,000 business leaders and senior managers is considered as positive, or bullish for the EUR, whereas a pessimistic view is considered as negative, or bearish.

Review Alex Nekritin's Article - Trading Euro with IFO Report

Last release: Wed Sep 24, 2025 08:00

Frequency: Monthly

Actual: 89.7

Consensus: 92

Previous: 91.6

Source: IFO Institute

,

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.