EUR/USD extends gains, US dollar drops ahead of US Michigan Consumer Sentiment data

- The Euro regains lost ground amid a more supportive risk mood, but it is still 0.35% down on the week.

- Bright US corporate earnings data and dovish comments from Fed Waller boost risk appetite on Friday.

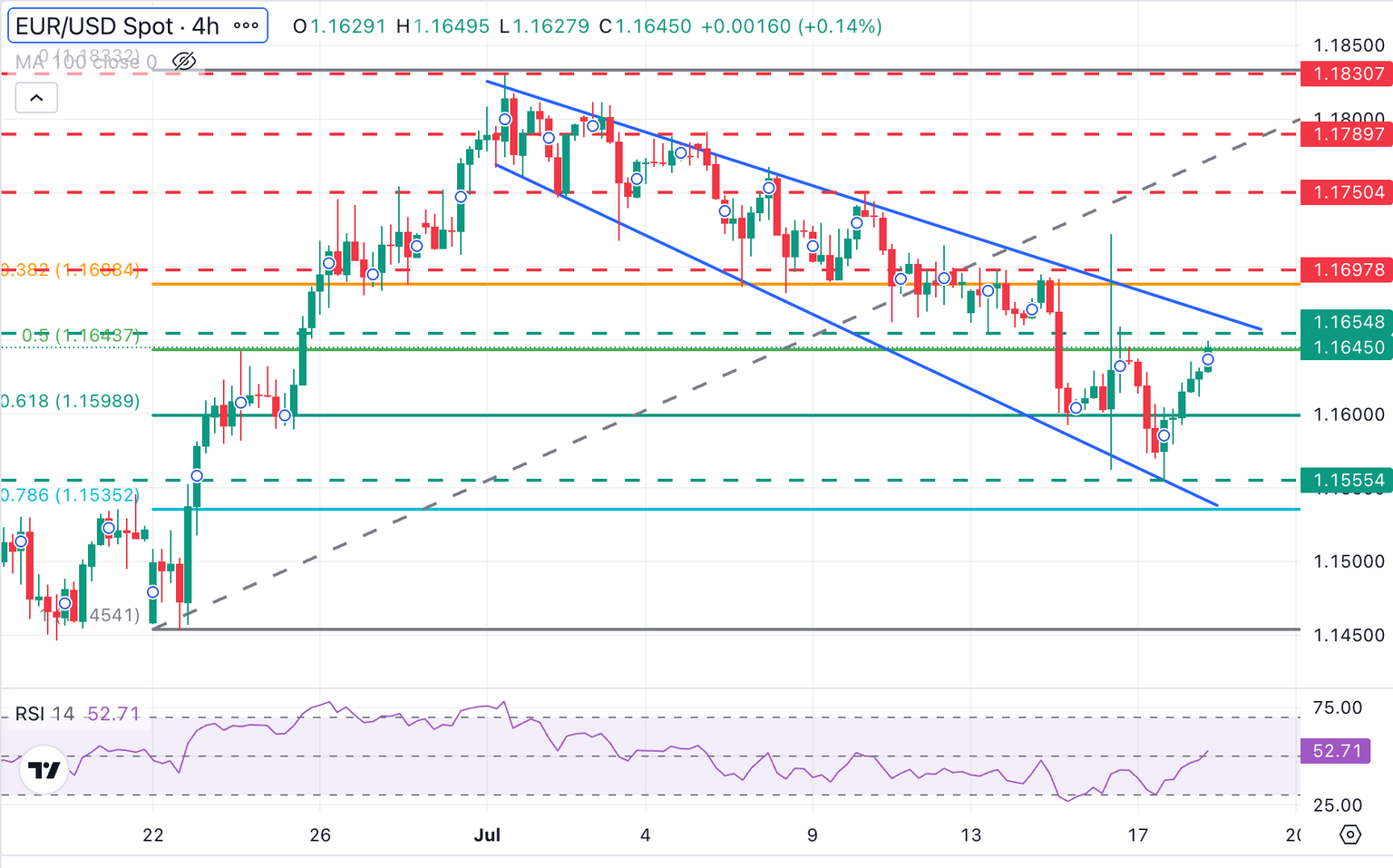

- EUR/USD maintains its broader bearish trend intact, with 1.1655 resistance likely to hold bulls.

The EUR/USD pair is posting a significant recovery on Friday, as the risk appetite observed in US and Asian extended into the European session. The positive market mood is buoying the Euro and weighing on the US Dollar and US Treasury yields ahead of the release of the US Michigan Consumer Sentiment Index report.

The Euro (EUR) rallies to 1.1645 on the European morning session, up from Thursday's three-week lows of 1.1555. The pair, however, remains about 0.3% below the weekly opening, on track for its second consecutive negative weekly performance.

A batch of upbeat corporate results was released on Thursday, with Netflix, the chipmaker TSMC, PepsiCo, and United Airlines beating expectations. These reports boosted market sentiment and triggered a further rally in Equities, weighing on the safe-haven US Dollar, and allowing the pair to bounce higher.

The sentiment has extended through the Asian and European sessions, further supported by dovish comments from Fed Governor Waller, who warned about increasing risks for the labor market and for the overall economic growth, and affirmed that the Fed should cut interest rates after its July meeting.

Earlier on Thursday, US economic data released revealed a strong recovery in Retail Sales in June and an unexpected decline in unemployment claims, which fell to their lowest level in the last three months on the week of July 12. These data, and the strong Consumer Price Index (CPI) seen earlier this week, have provided further reasons for the Federal Reserve (Fed) to maintain its monetary policy unchanged until the impact of tariffs clarifies.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.41% | -0.29% | -0.07% | -0.21% | -0.53% | -0.60% | -0.49% | |

| EUR | 0.41% | 0.14% | 0.35% | 0.20% | -0.12% | -0.30% | -0.07% | |

| GBP | 0.29% | -0.14% | 0.20% | 0.08% | -0.25% | -0.39% | -0.19% | |

| JPY | 0.07% | -0.35% | -0.20% | -0.13% | -0.46% | -0.64% | -0.32% | |

| CAD | 0.21% | -0.20% | -0.08% | 0.13% | -0.34% | -0.47% | -0.27% | |

| AUD | 0.53% | 0.12% | 0.25% | 0.46% | 0.34% | -0.14% | 0.05% | |

| NZD | 0.60% | 0.30% | 0.39% | 0.64% | 0.47% | 0.14% | 0.19% | |

| CHF | 0.49% | 0.07% | 0.19% | 0.32% | 0.27% | -0.05% | -0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Strong US data is underpinning the US Dollar

- US economic data this week shows the picture of a resilient economy, despite the higher inflationary trends stemming from Trump's tariffs. The combination of strong consumption with a healthy labour market and rising consumer prices has practically discarded an interest rate cut in July, and the odds for one in September are declining. In this context, losses in the US Dollar are expected to be limited.

- On Thursday, the US Census Bureau reported a 0.6% increase in June's Retail Sales, well above the 0.1% forecasted by market analysts and following a 0.9% contraction in May. Excluding automobiles, sales of all other products grew 0.5%, also beyond the 0.3% increment anticipated by the market consensus, which reveals that the improvement in consumption was broad-based.

- Beyond that, weekly Initial Jobless Claims declined to 221,000 on the week of July 12, from an upwardly revised 228,000 in the previous week and against expectations of an increase to 235,000.

- Finally, the Philadelphia Fed Manufacturing Index improved to 15.9, beating the market consensus, which had anticipated a -1 reading, following a -4 reading in the previous month.

- In the Eurozone, May's Current Account figures have shown a lower-than-expected increase on the region's surplus, which rose to EUR32.3 billion in May from EUR19.8 billion in the previous quarter, but below the market consensus of EUR34.8 billion.

- German Producer Price Index(PPI) data released on Friday has shown a 0.1% growth in inflation in June, a tick above the 0% market consensus, after a 0.2% contraction in May. Year-on-year, however, the PPI has contracted at a 1.3% rate, beyond May's 1.2% fall and extending the deflationary trend for the fourth consecutive month.

- Later today, July's Michigan Consumer Sentiment Index is expected to show an improvement to 61.5 from June's 60.7 reading. These figures would echo the strong retail sales figures seen on Thursday and add to the evidence of a resilient US economy.

EUR/USD recovery is likely to meet resistance at 1.1655

EUR/USD is bouncing up from Thursday's lows, but the broader trend remains bearish. The pair has kept trading lower within an expanding wedge since July 1. This figure highlights an emotional market and often anticipating a significant reversal.

Friday's price action shows easing bearish pressure, but the 4-hour Relative Strength Index (RSI) remains below the 50 level into negative territory, with a previous support level, at 1.1655 (July 11, 14 lows) likely to challenge bulls. Further up, the channel's top is at 1.1670, and the July 14 and 15 highs, right below 1.1700, are the next targets.

On the downside, the area between Thursday's low at 1.1555 and 1.1530, where the 78.6% Fibonacci retracement of the late June bullish run at 1.1535 crosses the wedge bottom, is a significant technical floor. Below there, the June 22 and 23 lows, at 1.1455, would come into focus.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Jul 18, 2025 14:00 (Prel)

Frequency: Monthly

Consensus: 61.5

Previous: 60.7

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Economic Indicator

UoM 1-year Consumer Inflation Expectations

The University of Michigan's Inflation Expectations gauge captures how much consumers anticipate prices will change over the coming 12 months. It comes out in two rounds—a preliminary release that tends to pack a bigger punch, followed by a revised update two weeks later.

Read more.Next release: Fri Jul 18, 2025 14:00 (Prel)

Frequency: Monthly

Consensus: -

Previous: 5%

Source: University of Michigan

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.