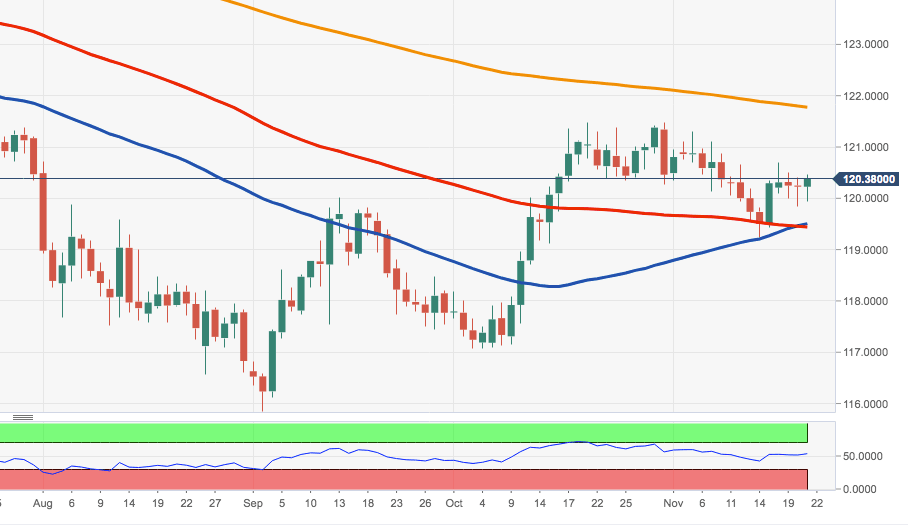

EUR/JPY Technical Analysis: Flirting with the 21-day SMA near 120.50

- The weekly sideline theme in EUR/JPY remains unchanged so far.

- The resumption of the selling pressure should target monthly lows near 119.20.

The price action in EUR/JPY continues to struggle with the 21-day SMA in the vicinity of 120.50.

The persistent inability of the cross to surpass this key barrier has sparked the ongoing consolidative phase, always on the back of developments from the US-China trade front.

The resumption of the downside pressure is expected to meet initial support in the 119.50/24 band, where converge the 100-day and 55-day SMAs as well as monthly lows recorded on November 14th.

In order to alleviate the immediate downside pressure, the cross needs to overcome weekly highs around 120.50, ideally in the short-term horizon.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.