EUR/JPY rises on EU-US trade deal hopes as Trump announces 25% tariffs on Japan

- EUR/JPY extends gains as hopes of a US-EU trade deal support the upside move.

- The Euro strengthens as investor sentiment improves and German Industrial Output beats expectations.

- President Trump announces a 25% tariff on all imports from Japan, effective from August.

The Euro (EUR) is strengthening against the Japanese Yen (JPY) as investors shift focus to trade talks ahead of the Wednesday tariff deadline.

The Yen is under pressure after US President Donald Trump announced a 25% tariff on all imports from Japan.

EUR/JPY is currently trading around 171.10, up 0.58% on the day, its highest level in almost a year.

Euro strengthens on solid German industrial output and rising investor sentiment

German Industrial Production, released on Monday, rebounded in May, rising by 1.2% MoM, beating expectations and the previous month's figure of -1.6%.

Annual output also improved to 1% from a 2.1% contraction, signaling renewed momentum in the manufacturing sector. Meanwhile, monthly Eurozone Retail Sales fell by 0.7% in May, matching expectations and highlighting continued consumer caution.

The annual figure rose by 1.8%, exceeding the 1.2% forecast and softening concerns over demand.

Adding to the positive tone, Sentix Investor Confidence for July surged to 4.5, well above the 0.2 consensus. The data marked the first meaningful improvement in sentiment in months and suggested growing optimism within the bloc.

EUR/JPY remains sensitive to trade talks and tariff threats

US President Donald Trump and European Commission President Ursula von der Leyen discussed bilateral relations during a phone call on Sunday.

They were brought together to expedite negotiations regarding a US-EU trade agreement before Wednesday's deadline for tariffs.

In its Monday report, Reuters quoted European Commission spokesman Stefan De Keersmaecker as saying that there was a “good exchange” between the two leaders.

Neither Japan nor the European Union has reached a trade agreement with the United States (US). Its negotiations with Japan were halted in midstream due to its reluctance to purchase rice imports from the US.

Bloomberg has reported that President Trump has sent a letter to Japan informing them that a 25% tariff will be imposed on all imports to the US, effective August 1.

EUR/JPY flirts with psychological resistance at 171.00

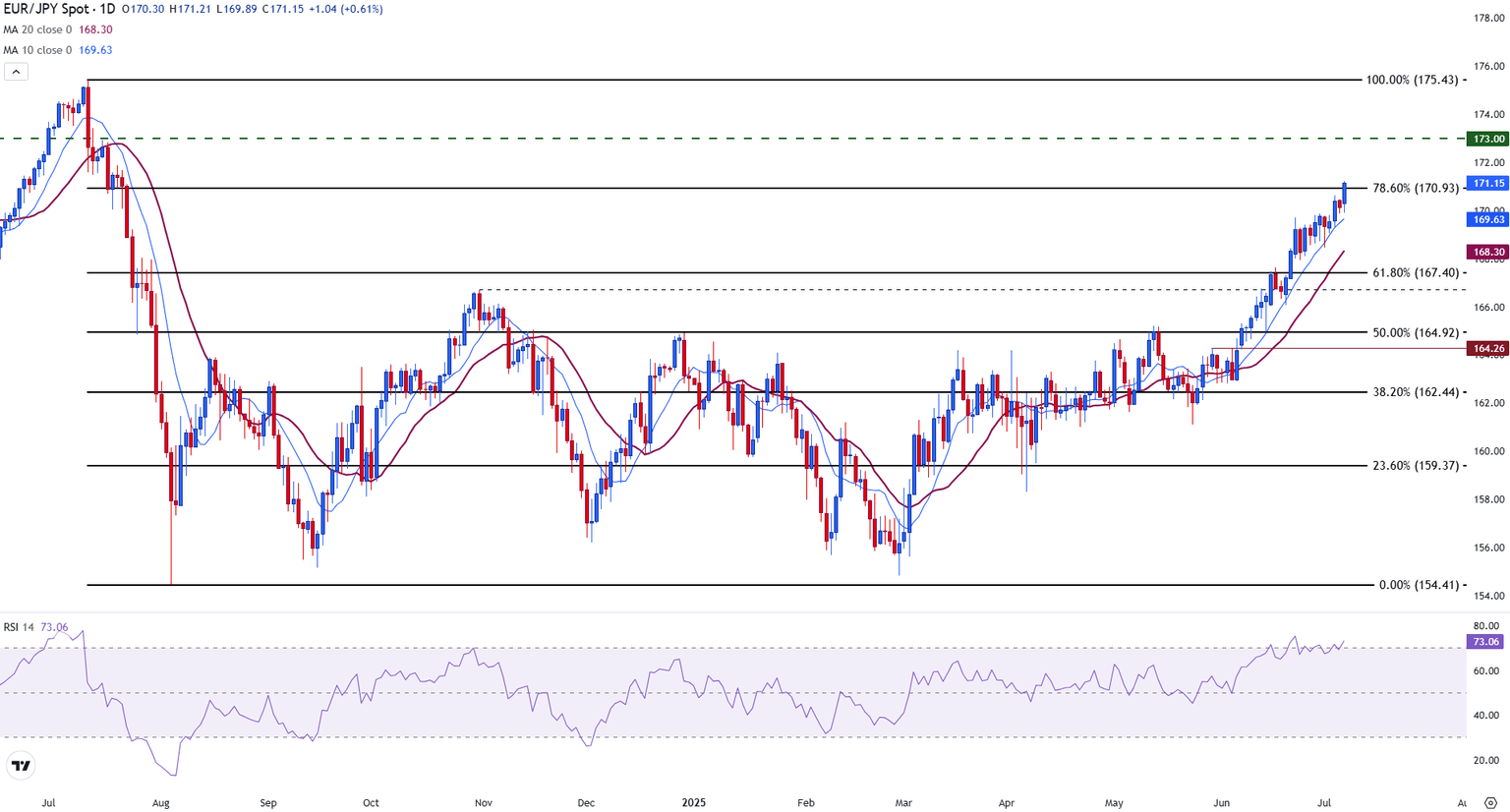

EUR/JPY continues to trend higher, extending its bullish breakout above the 78.6% Fibonacci retracement level of the July-August 2024 decline at 170.93.

The 10-day Simple Moving Average (SMA) provides support at 169.64, with the 20-day SMA forming an additional price floor at 168.30. The moving averages remain steeply inclined, reinforcing bullish conditions.

However, the Relative Strength Index (RSI) is hovering in overbought territory above 73, suggesting the risk of a near-term pullback or consolidation.

EUR/JPY daily chart

Immediate resistance lies around 171.30, followed by the key 173.00 level and the July 2024 high at 175.43.

On the downside, former resistance at 170.00 and the 61.8% retracement at 167.40 now act as support. The technical structure remains positive while price holds above the 168.30–167.40 zone.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.