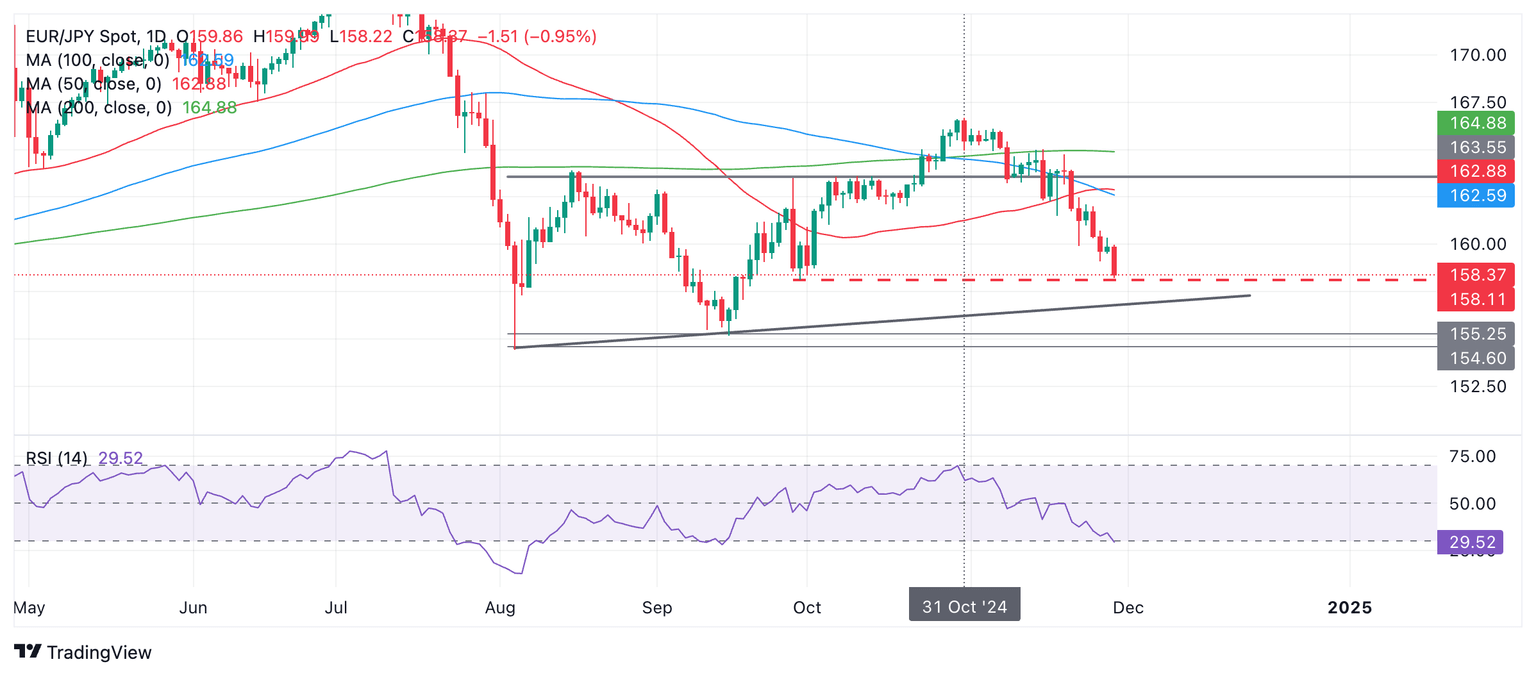

EUR/JPY Price Prediction: Falls to close to support level as downtrend takes hold

- EUR/JPY is falling to a key support level after tumbling further on Friday.

- It could bounce once it touches the level and the RSI is oversold on an intraday basis, cautioning aggressive short-sellers.

EUR/JPY extends its downtrend since the Halloween peak and is within spitting distance of hitting key support at the September 30 swing low of 158.11 (red dashed line on chart).

It is now probably in a short-term downtrend and given it is a principle of technical analysis that trends have a tendency to extend themselves, the odds favor EUR/JPY falling to lower lows.

EUR/JPY Daily Chart

At the September 30 low the pair will probably find its feet and bounce. The Relative Strength Index (RSI) momentum indicator is in the oversold zone (below 30) on an intraday basis. If the pair closes with RSI still in oversold it will be a signal for short-holders not to add to their short positions. The risks of a pullback will also be greater.

A deeper sell-off could take EUR/JPY down to the trendline at around 157.00 or even all the way to 154.00 – 155.00, the August-September lows.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.