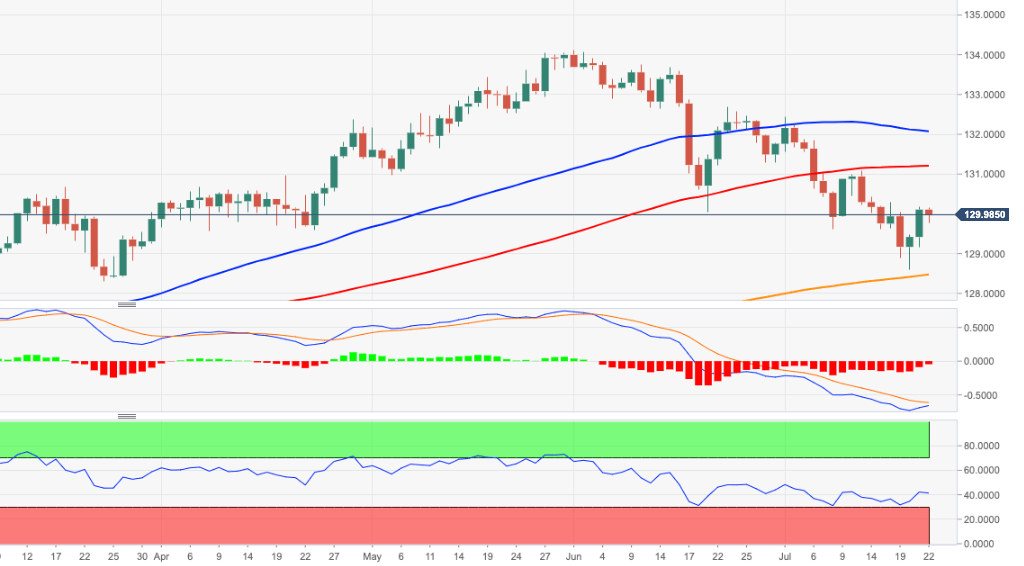

EUR/JPY Price Analysis: Upside capped just above 130.00

- EUR/JPY’s recovery falters in the 130.20 area so far.

- The next hurdle of note comes in at the 131.00 region.

After bottoming out in the mid-128.00s in the first half of the week, EUR/JPY seems to have regained some composure. However, the bullish attempt appears to have run out of steam just past the psychological 130.00 mark.

The continuation of the recovery could extend to the 131.00 neighbourhood, where coincides weekly highs and the 100-day SMA. The surpass of this area should mitigate the downside pressure.

In the meantime, a move to the 200-day SMA near 128.41 should also be negated if the cross manages to clear 131.00, ideally in the very short term.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.