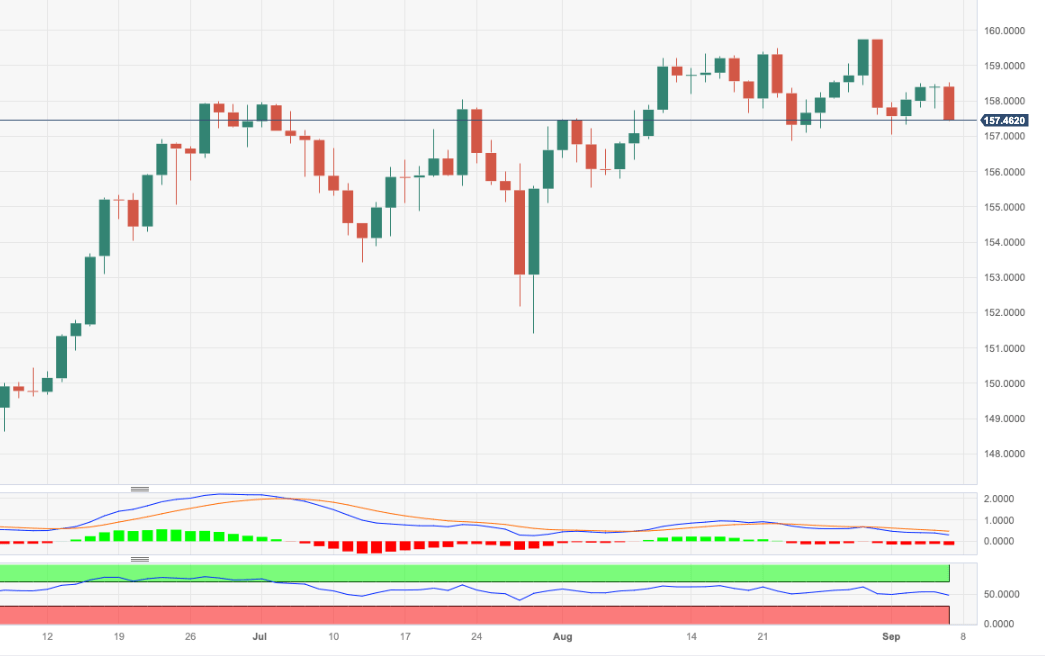

EUR/JPY Price Analysis: Some consolidation ahead of further gains?

- EUR/JPY halts a three-day positive streak and drops to 157.50.

- The vicinity of 160.00 continues to cap the upside so far.

EUR/JPY comes under some marked selling pressure and recedes to the area of weekly lows in the mid-157.00s.

In the meantime, the cross could move into a consolidative phase ahead of the potential resumption of the uptrend. That said, immediate hurdle emerges at the recent 2023 peak at 159.76 (August 30) prior to the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.33.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.