EUR/JPY Price Analysis: Scope for extra rangebound

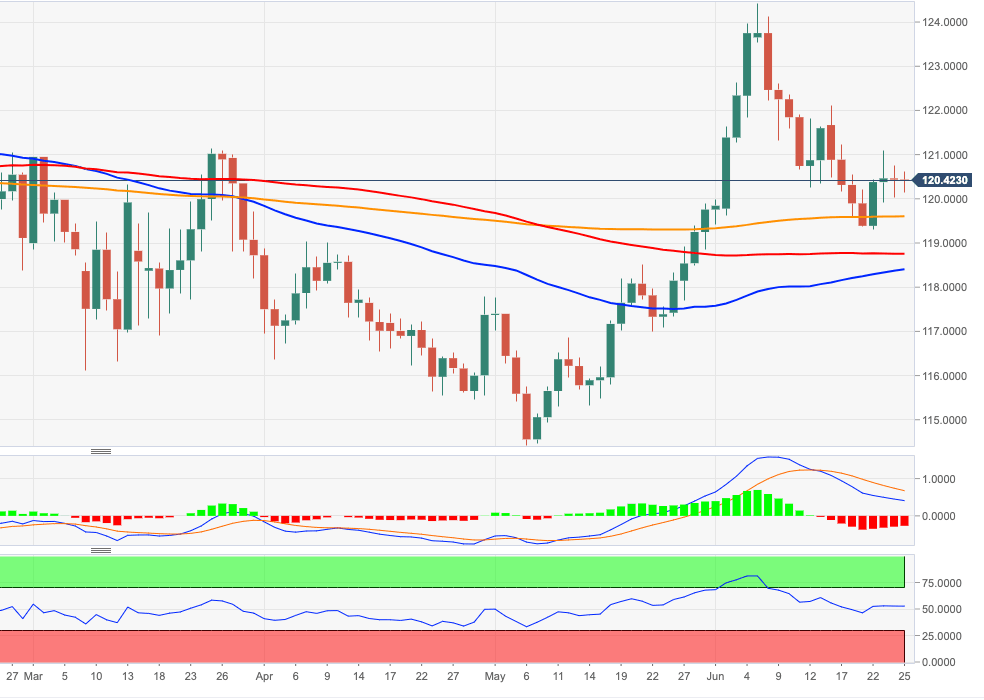

- EUR/JPY met a tough barrier in the 121.00 region so far this week.

- Further up is located the next stop at the 122.00 barrier.

Following a failed attempt to surpass the 121.00 mark earlier in the week, EUR/JPY is now looking to stabilize in the mid-120.00s so far this week. The 121.00 zone coincides as well with March’s tops.

In the meantime, solid support appears to have emerged at the 200-day SMA in the mid-119.00s. A break below this area should pave the way for a deeper pullback in the short-term horizon.

On the broader outlook, while above the 200-day SMA at 119.55, the stance on the cross is predicted to remain positive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.