EUR/JPY Price Analysis: Room for extra upside near term

- EUR/JPY adds to Thursday’s gains and prints new highs.

- Further upside could target the 149.80 region in the short term.

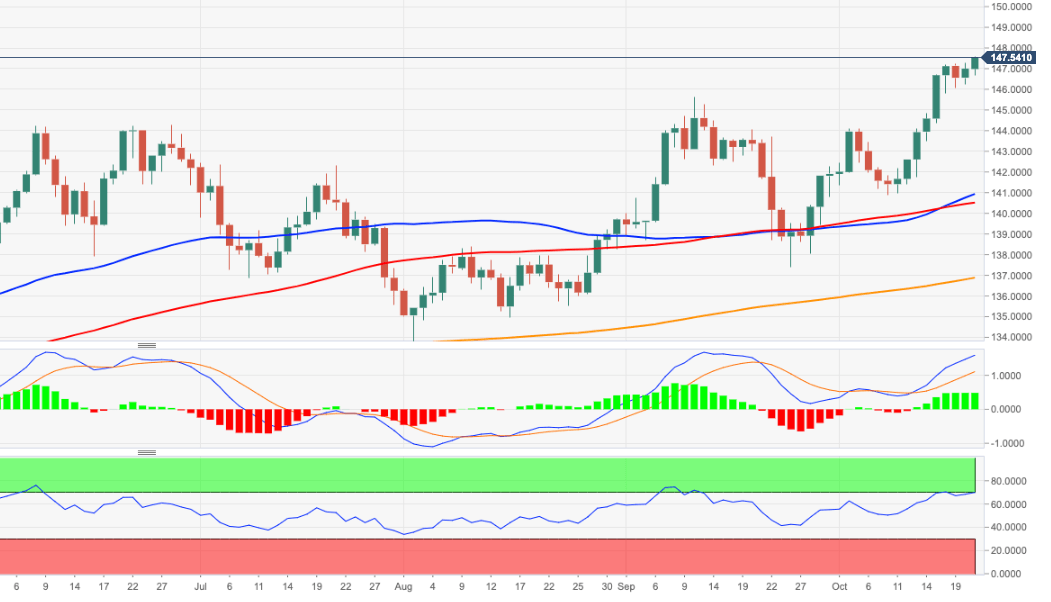

EUR/JPY extends the optimism seen in the second half of the week and advances to new cycle highs around 147.60 on Friday.

Considering the current price action in the cross, the door still looks open to extra upside. That said, the immediate target now emerges at the December 2014 high at 149.78 (December 8).

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 136.85, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.