EUR/JPY Price Analysis: Next hurdle comes at 144.04

- EUR/JPY extends the recovery north of the 140.00 yardstick.

- The continuation of the rebound targets the weekly high at 144.04.

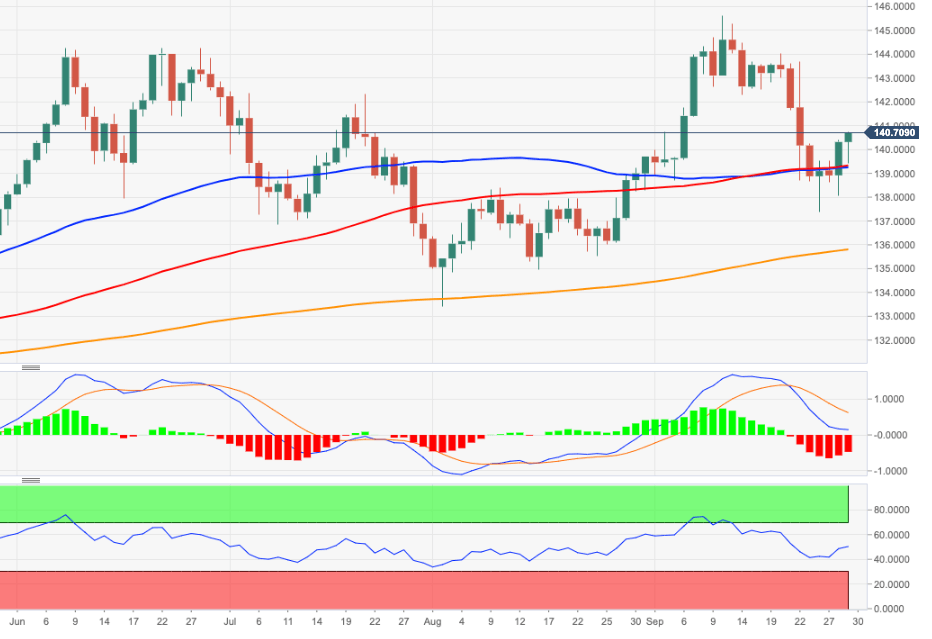

EUR/JPY adds to Wednesday’s bounce and manages to advance to multi-day peaks near 140.70 on Thursday.

Considering the ongoing price action, further upside should not be ruled out. That said, if the bullish impulse gathers steam, the cross should meet the next up barrier at the weekly top at 144.04 (September 20).

Looking at the longer term, the constructive stance is expected to persist while above the 200-day SMA, today at 135.77.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.