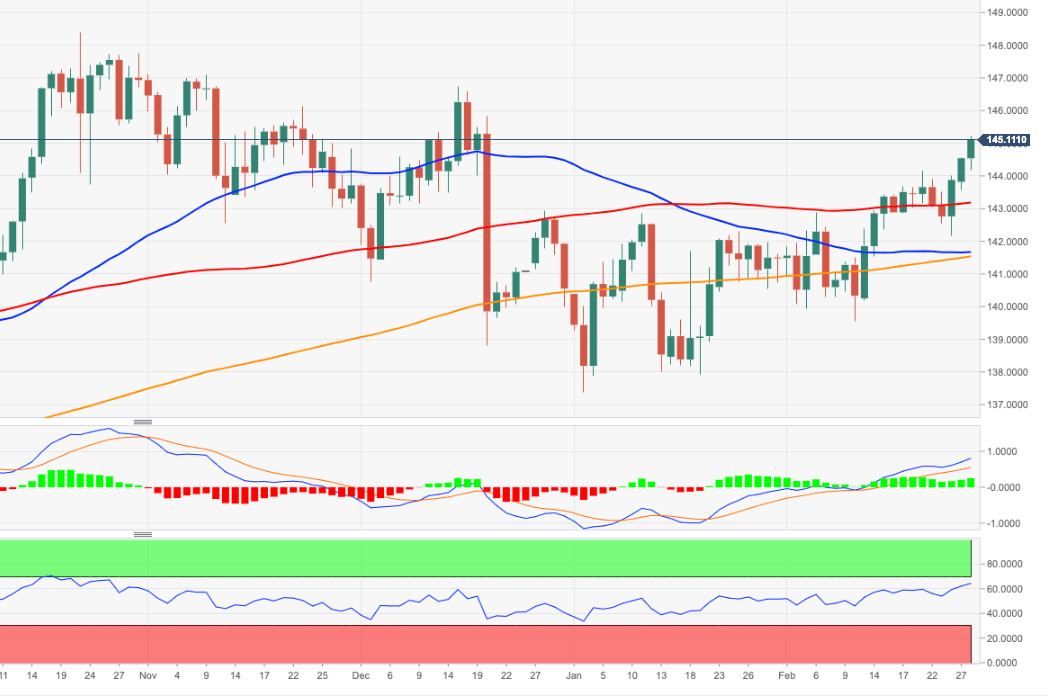

EUR/JPY Price Analysis: Immediately to the upside emerges 146.70

- EUR/JPY climbs to fresh yearly highs past the 145.00 mark on Tuesday.

- Further up comes the December 2022 high near 146.70.

EUR/JPY adds to the ongoing strong rebound and surpasses the key hurdle at 145.00 the figure on Tuesday.

The continuation of the current upside momentum should challenge the December 2022 top at 146.72 (December 15) ahead of the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.50, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.