EUR/JPY Price Analysis: Further rangebound now looks likely

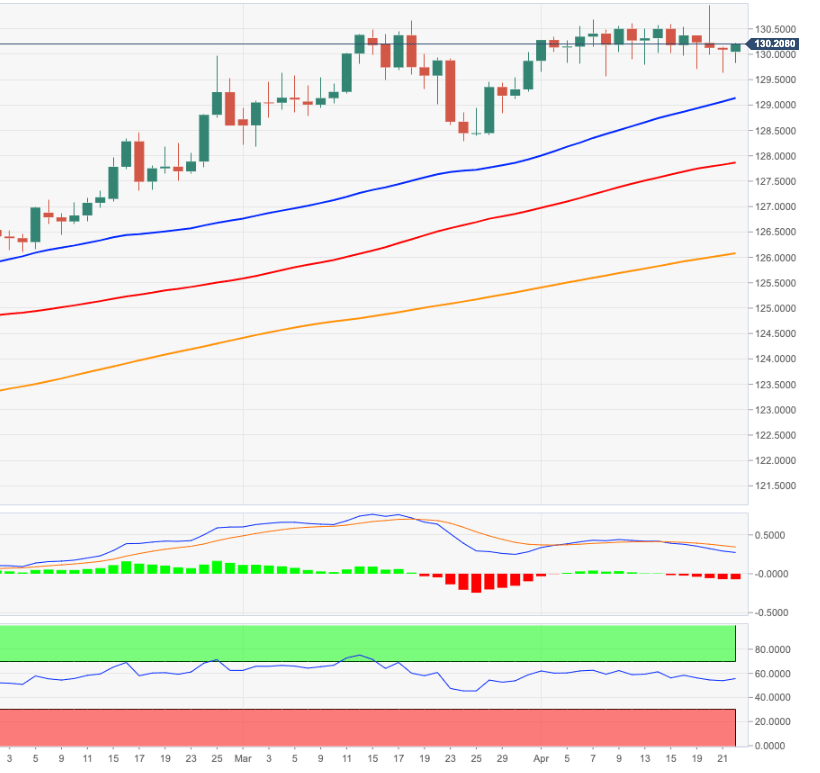

- EUR/JPY regains the 130.00 mark and is up smalls on Thursday.

- Next on the upside comes in the YTD tops near 131.00.

EUR/JPY manages to so far reverse three consecutive daily pullbacks and retakes the 130.00 level after hitting new YTD peaks just below 131.00 the figure on Tuesday.

Current price action suggests further consolidation remains well on the cards in the near-term. On the downside, decent contention is seen emerging in the mid-12900s ahead of the minor support at the 50-day SMA around 129.30.

A break below the 5-month support line near 128.90 should alleviate the upside pressure somewhat an allow for a move lower to the next target at the late March lows in the 128.30/25 band (March 24).

In the meantime, while above the 200-day SMA at 126.00 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.