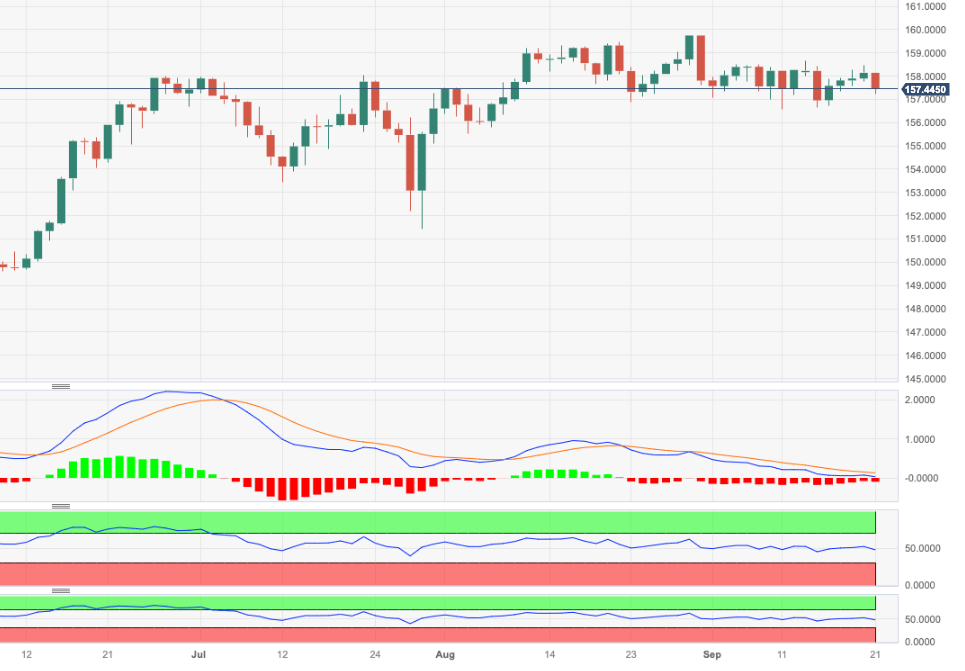

EUR/JPY Price Analysis: Further range bound on the cards

- EUR/JPY halts a four-session positive streak and revisits 157.20.

- Bullish attempts keep targeting the September top around 158.65.

EUR/JPY comes under marked selling pressure, revisiting the low-157.00s and reversing four consecutive daily advances on Thursday.

In the meantime, the cross remains stuck within the consolidative range and the breakout of it exposes a visit to the so far monthly high of 158.65 (September 13) prior to the 2023 top at 159.76 (August 30), which precedes the key round level at 160.00.

The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.96.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.