EUR/JPY Price Analysis: Further range bound looks likely

- EUR/JPY drops to three-day lows following Wednesday’s monthly highs.

- Further consolidation appears on the cards in the very near term.

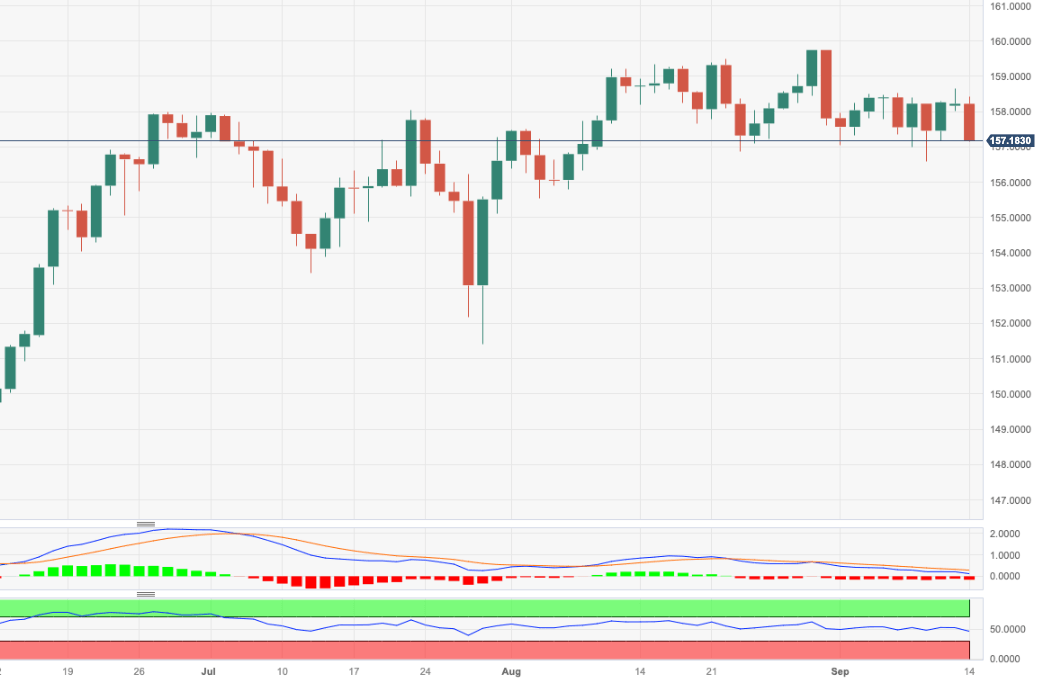

EUR/JPY retreats from Wednesday’s monthly highs around 158.60 and revisits the vicinity of the 157.00 zone, or three-day lows, on Thursday.

In the meantime, the cross continues to face some side-lined trading prior to a potential resumption of the uptrend. That said, a minor hurdle emerges at the so far monthly high of 158.65 (September 13) ahead of the 2023 top at 159.76 (August 30) and before the key round level at 160.00. The surpass of the latter should not see any resistance level of note until the 2008 high at 169.96 (July 23).

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 148.70.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.