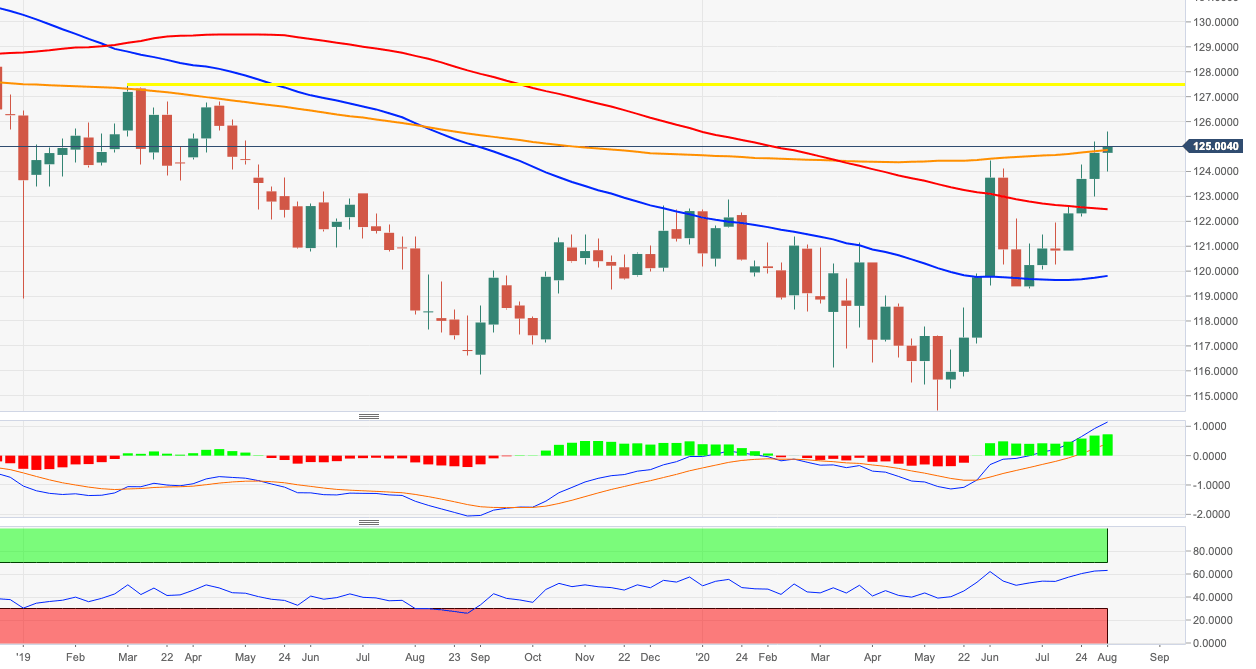

EUR/JPY Price Analysis: Further downside could see 124.00 re-tested

- EUR/JPY recorded new 2020 highs in the 125.55/60 band on Thursday.

- The March 2019 high near 127.50 is the next target of significance.

EUR/JPY’s rally has managed to hit fresh tops near 125.60 during early trade in the second half of the week, just to come under some selling pressure soon afterwards.

In spite of the ongoing correction, extra gains remain well on the cards and underpinned by the generalized improvement in the risk complex. Against this, the next area of interest emerges at the mid-127.00s, where sits the March 2019 high.

If sellers remain in control in the short-term, then EUR/JPY should meet initial contention in the weekly lows around the 124.00 mark (August 3).

EUR/JPY weekly chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.