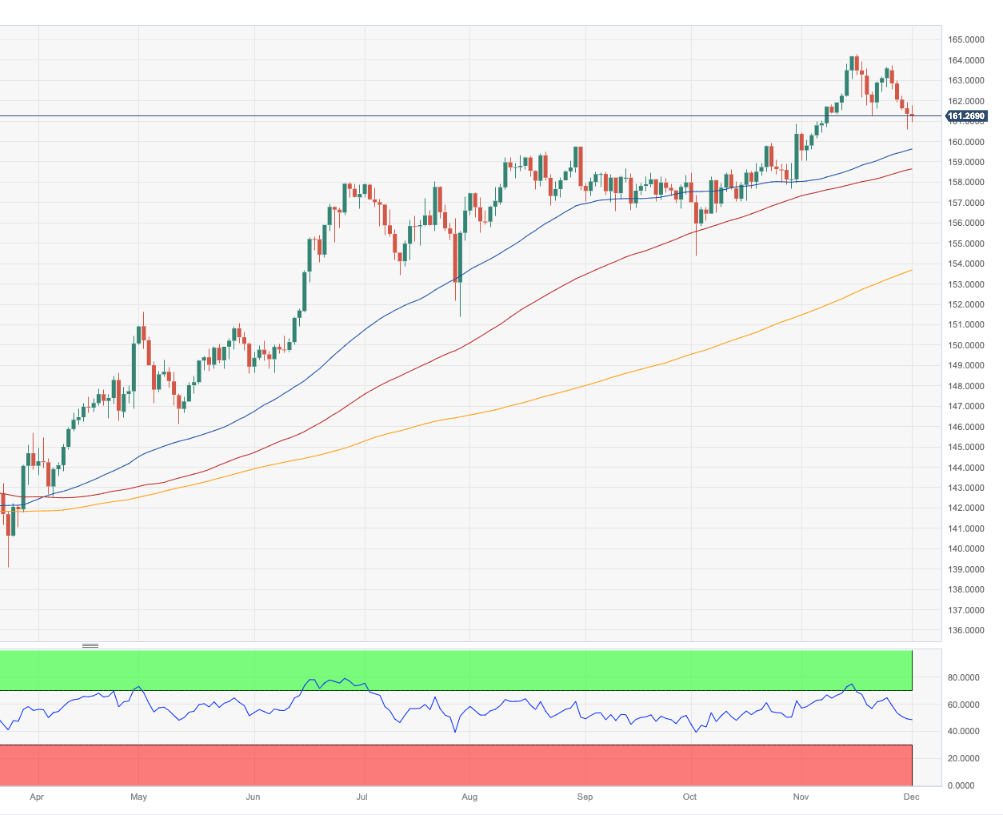

EUR/JPY Price Analysis: Further down comes the 55-day SMA

- EUR/JPY appears side-lined in the low 161.00s on Friday.

- Further losses should face provisional support near 159.60.

EUR/JPY alternates ups and downs around 161.30 on Friday, extending the consolidative mood in the lower end of the recent range.

The continuation of the downward bias carries the potential to motivate the cross to break below the 160.00 round level and revisit the interim 55-day SMA at 159.58.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA at 153.64.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.