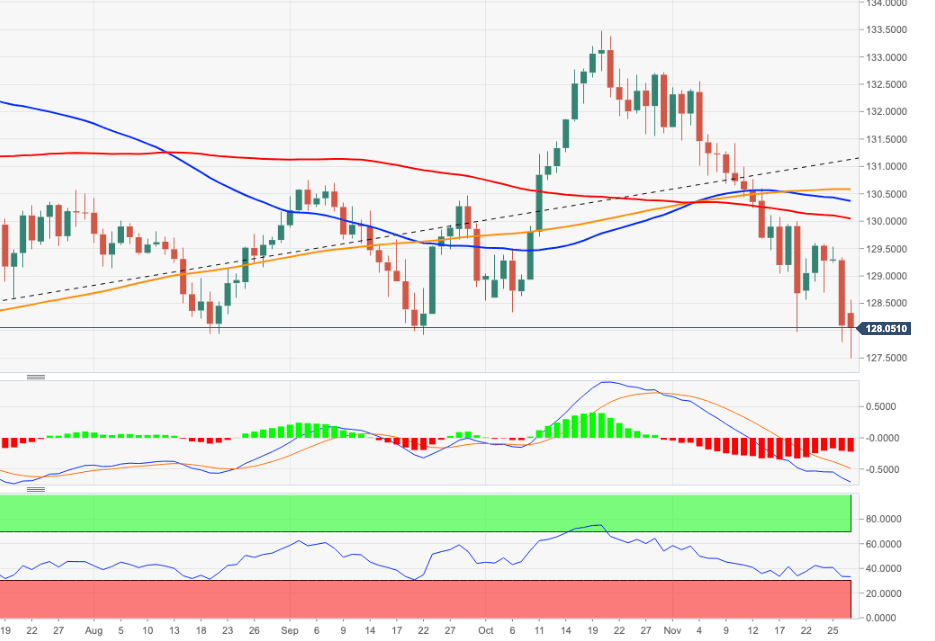

EUR/JPY Price Analysis: Extra losses could see the 2021 low retested

- EUR/JPY adds to the recent pullback and retests 128.00.

- Further south comes the August/September lows at 127.93.

EUR/JPY extends the leg lower and breaks below 128.00 to clinch fresh 9-month lows in the id-127.00s on Monday.

The continuation of the downtrend remains well on the cards for the time being. A sustainable breach of 127.48 (November 29) exposes a deeper pullback to the 2021 lows in the 125.00 neighbourhood (January 18).

Looking at the broader picture, the outlook for the cross is expected to remain negative while below the 200-day SMA, today at 130.54.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.