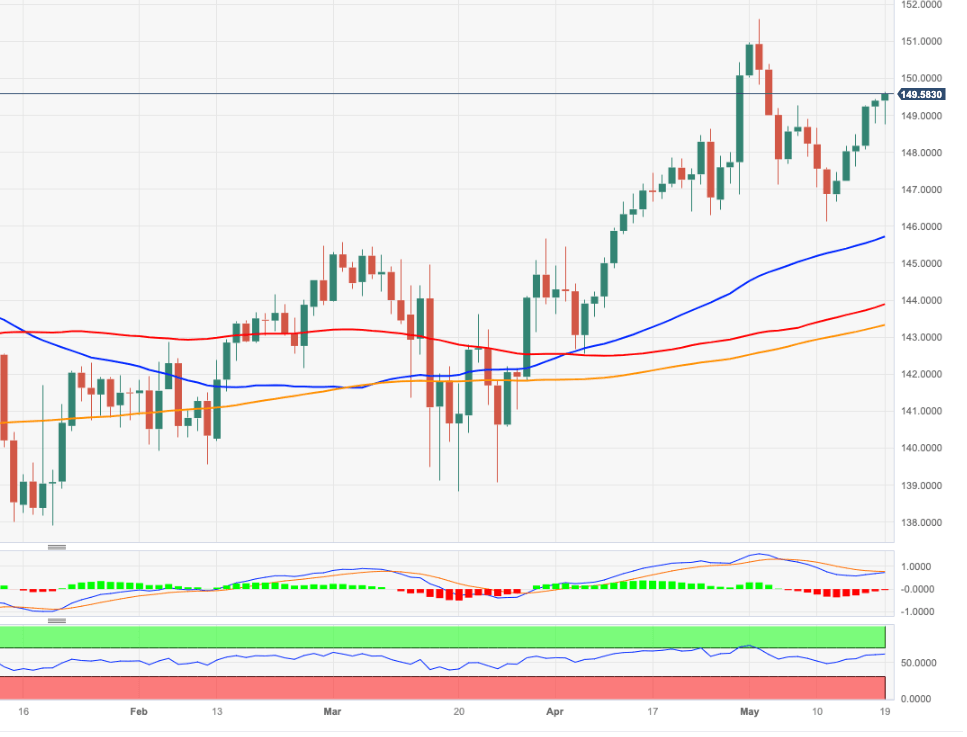

EUR/JPY Price Analysis: Beyond 150.00 comes the 2023 peak

- The weekly rally in EUR/JPY remains unabated so far.

- Further north of 150.00 emerges the YTD high at 151.61.

EUR/JPY maintains the bullish bias for yet another session and approaches the 150.00 barrier at the end of the week.

If the cross clears the key round level at 150.00, it could then embark on a probable move to the 2023 top at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.29.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.