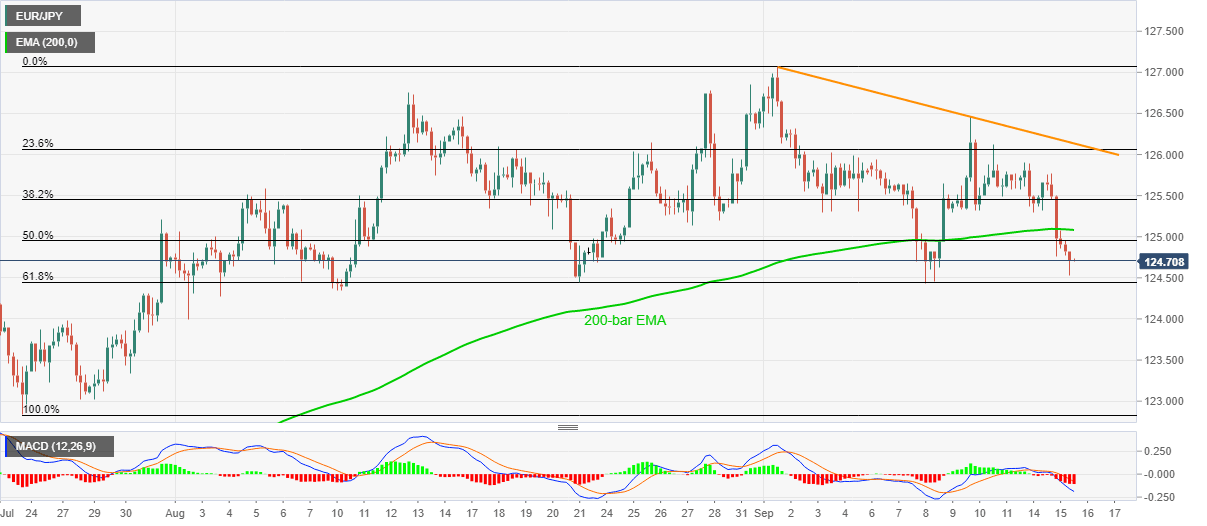

EUR/JPY Price Analysis: Bears again aim for 61.8% Fibonacci retracement

- EUR/JPY fades pullback from an intraday low of 124.52.

- Bearish MACD, failures to keep bounces off the key Fibonacci retracement favor sellers.

- 200-bar EMA, monthly falling trend line challenge buyers.

EUR/JPY prints 0.15% intraday losses while easing to 124.73 ahead of Wednesday’s European session.

Given the pair’s another downside break of 200-bar EMA, sellers are currently targeting a 61.8% Fibonacci retracement of the run-up from July 24 to September 01, around 124.45. Also acting as an additional filter to the EUR/JPY south-run is July 30 top around 124.30.

Should the quote manages to drop beneath 124.30, bears can aim for 123.90 and the 123.00 threshold.

Alternatively, a sustained break of 200- bar EMA, currently around 125.10, will direct buyers towards a falling trend line from September 01, at 126.13 now.

If at all the EUR/JPY bulls manage to cross the stated resistance line, the resultant upward trajectory can aim for 126.50 and the monthly top of 127.07.

EUR/JPY four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.