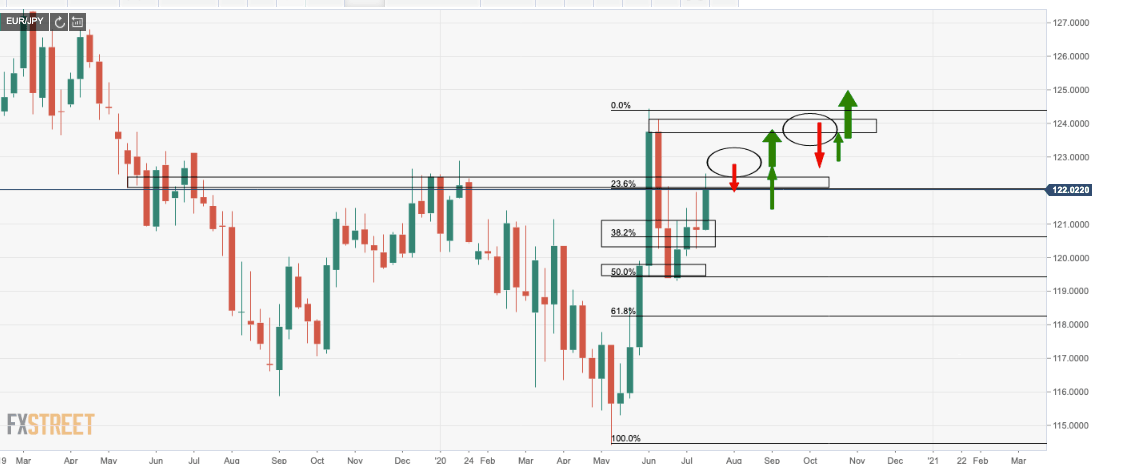

EUR/JPY: Bear's last dance to a 38.2% Fibonacci target before bulls re-engage

EUR/JPY is showing signs of strength, however, while the double bottom on the monthly chary points to a likely upside extension, there is plenty of leg work to do yet.

The cross is facing headwinds technically, although the fundamental case is certainly favour of the bulls given the coronavirus vaccine headlines and bullish bank earnings, so far, this week.

- Wall Street Close: Bulls fully back in charge on hopes of vaccine breakthrough

- Oxford scientists believe they could have breakthrough on Covid-19 vaccine – Telegraph

From a top-down analysis, the immediate outlook for near term price action is bearish, from a structural point of view.

Bears may have one last dance before committed bulls looking for a bargain will fully commit.

We start with the monthly chart as follows and work our way down:

Monthly support, double bottom?

Weekly barroom brawls on the cards?

Daily stops taken out with bullish pin bar, fueling the bid through key resistance structure

Test of 38.2% Fibonacci to fule upside on the daily outlook

4HR resistance being tested

15-min retest of counter-trendline, prospects for lower from old support turns resistance

At this very moment, the price action opens risk of a break to the downside, below the circled pin-bar.

A retest of that support should act as resistance before price can extend lower for the daily aforementioned target.

Ideally, bears will wish to see the price break below a 20-moving average before looking for entities.

At the time of writing, the price was making its move already, however, MACD is still just about bullish above zero, so there is still time for the market to develop.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.