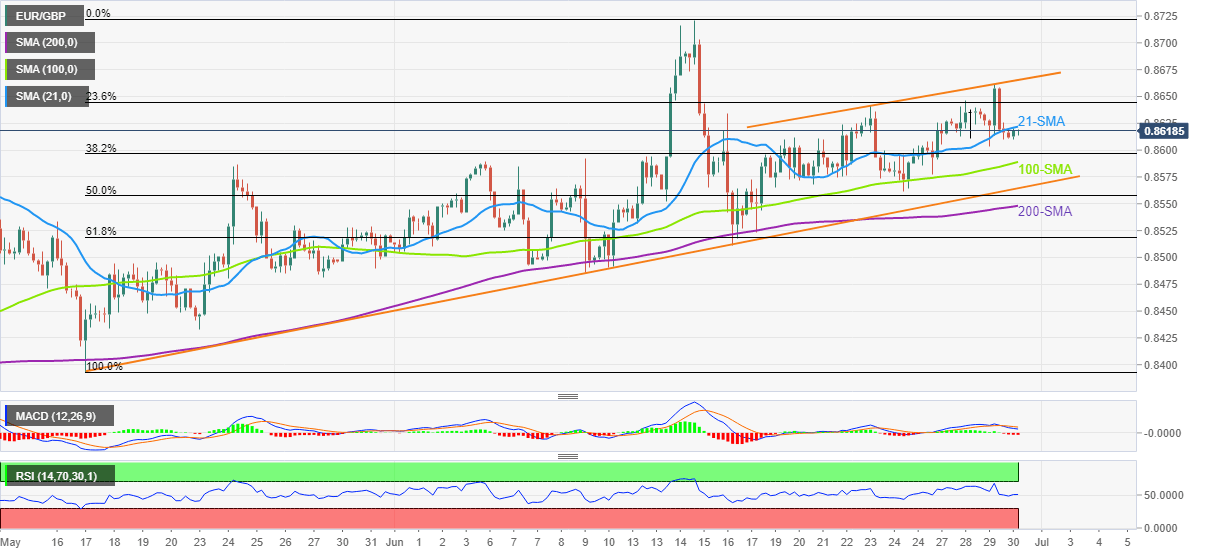

EUR/GBP Price Analysis: Retreats from 21-SMA but stays on the bull’s radar above 0.8600

- EUR/GBP keeps the previous day’s pullback from fortnight high, pressured around intraday low.

- Multiple SMAs, ascending trend line from mid-May joins steady RSI to keep buyers hopeful.

- Weekly resistance line adds to the upside filters.

EUR/GBP remains depressed around 0.8615 heading into Thursday’s European session, extending the previous day’s pullback from a two-week top below 21-SMA.

Given the bearish MACD signals and the cross-currency pair’s break of immediate SMA, the EUR/GBP prices are likely to drop towards the 100-SMA level of 0.8590.

However, an ascending trend line from May 17, near 0.8565, joins a steady RSI to keep the pair buyers hopeful.

Even if the quote drops below 0.8565 support, the 50% Fibonacci retracement of the May-June upside and the 200-SMA, respectively near 0.8560 and 0.8550, will challenge the EUR/GBP bears before giving them control.

Meanwhile, the 21-SMA level of 0.8621 guards the quote’s immediate recovery ahead of the 23.6% Fibonacci retracement level of 0.8645.

Following that, an upward sloping resistance line from the last Thursday, at 0.8668 by the press time, could act as the last defense of the EUR/GBP sellers.

In a case where the pair rises past 0.8668, the odds favoring a run-up towards the 0.8700 and then to the monthly high of 0.8721 can’t be ruled out.

EUR/GBP: Four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.