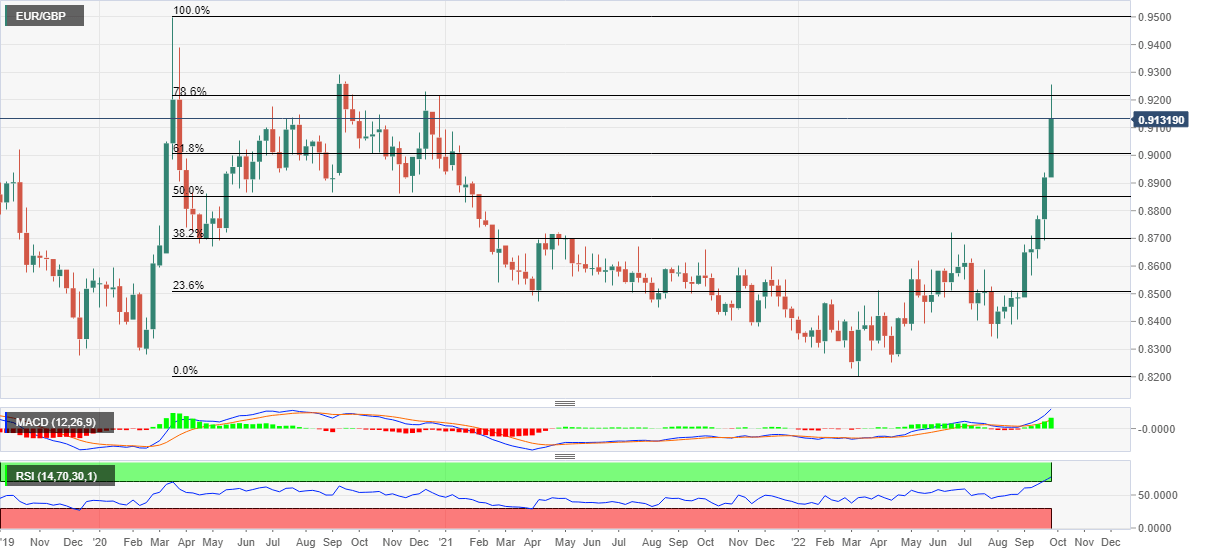

EUR/GBP Price Analysis: Further upside hinges on 0.9160 breakout

- EUR/GBP retreats after refreshing two-year high, sluggish of late.

- Bulls need validation from the key Fibonacci retracement hurdle.

- Sellers could take risks unless the quote drops below 0.8715.

- Bullish bias fades amid overbought RSI, nearness to key resistances.

EUR/GBP struggles to extend the latest run-up to the highest levels since September 2020, retreating to 0.9133 heading into Monday’s European session. In doing so, the cross-currency pair justifies the overbought RSI (14), as well as the importance of the Fibonacci retracement levels of the March 2020 to March 2022 downturn.

That said, the quote’s latest pullback, however, needs validation from the 61.8% Fibonacci retracement level of the 0.9000 psychological magnet to extend the south-run.

Following that, the 50% Fibonacci retracement level near 0.8850 can entertain the EUR/GBP bears before directing them to the tops marked during April 2021 and June 2022, around 0.8720.

Alternatively, the EUR/GBP prices need a weekly closing beyond the 78.6% Fibonacci retracement level near 0.9215-20 to keep the buyers hopeful.

In that case, the late March 2020 high near 0.9390 could offer an intermediate halt during the run-up to the year 2020 peak surrounding the 0.9500 mark.

To sum up, EUR/GBP is likely to remain firmer but the short-term pullback can’t be ruled out.

EUR/GBP: Weekly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.