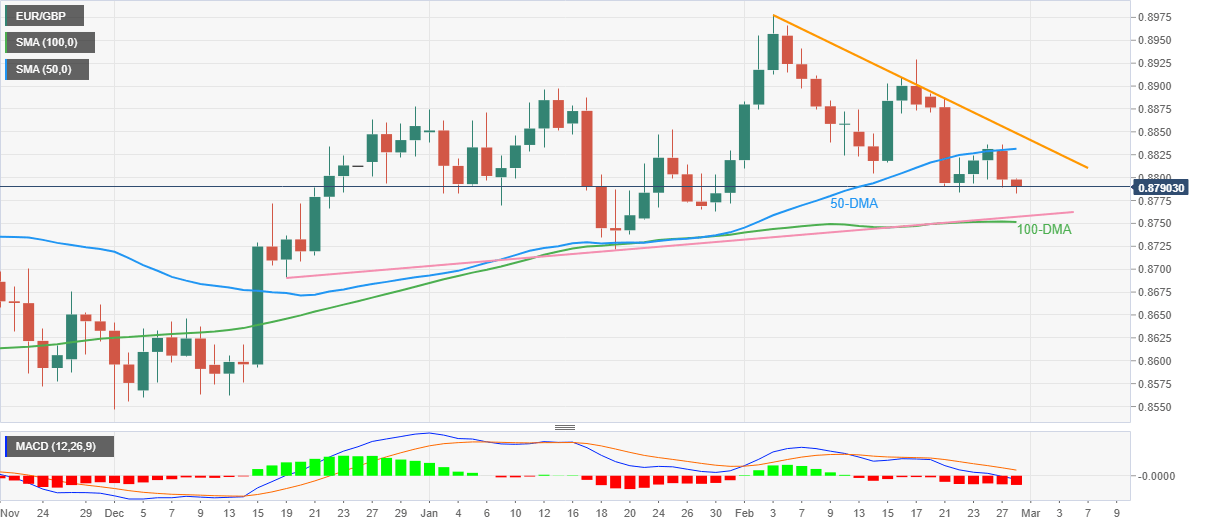

EUR/GBP Price Analysis: Bears occupy driver’s seat around 0.8800 threshold

- EUR/GBP holds lower ground at monthly bottom, extends pullback from 50-DMA.

- Lower-high formation keeps sellers hopeful amid bearish MACD signals.

- 2.5-month-old ascending support line, 100-DMA lures bears during further downside.

- Bulls need validation from three-week-long falling resistance line.

EUR/GBP remains depressed around 0.8790, refreshing the monthly low, as traders brace for Tuesday’s European session. In doing so, the cross-currency pair extends the previous day’s pullback from the 50-DMA hurdle amid bearish MACD signals.

Also keeping the EUR/GBP sellers hopeful is the pair’s lower high formation, as portrayed by a three-week-old descending resistance line surrounding 0.8850 by the press time.

That said, the pair sellers appear well-set to drop towards an upward-sloping support line from December 19, 2022, close to 0.8760. However, the pair’s further downside is likely to be limited by the 100-DMA support level near 0.8750.

In a case where the cross-currency pair remains weak past 0.8750, the lows marked in January 2023 and late December 2022, respectively near 0.8720 and 0.8690, could act as additional downside filters.

Meanwhile, EUR/GBP recovery remains elusive unless the quote stays below the 50-DMA hurdle of 0.8831.

Even if the quote rises past 0.8831, the aforementioned three-week-old resistance line could challenge the pair buyers near 0.8850.

Following that, the mid-February swing high surrounding 0.8930 appears the last defense of the EUR/GBP bears.

EUR/GBP: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.