EUR/GBP explores fresh lows sub-0.8380 as Eurozone data fails to inspire

- The Euro extends losses for the fourth consecutive day to test fresh eight-month lows.

- Soft Eurozone data and dovish ECB comments have added pressure on the Euro.

- The broader EUR/GBP trend remains negative, with the 0.8325 support coming into view.

The Euro extends losses for the fourth consecutive day against the British Pound, weighed by uninspiring Eurozone economic data and dovish comments by ECB policymaker Francois Villeroy.

In Germany, the GFK Consumer Sentiment Index has ticked in from last week’s lows but remains at extremely low levels, and, anyway, somewhat below market expectations.

Weak Eurozone data and dovish ECB’s Villeroy weigh on the Euro

Somewhat later, the Eurozone Consumer Confidence has remained unchanged at -15.2 levels below the long-term average.

The moderate improvements on the Economic confidence, 94.8 from 93.6 in April, and the Industrial confidence, up to -10.3 from -11, have been unable to alter the Euro’s bearish tone.

Beyond that, the dovish comments from ECB’s Villeroy, suggesting that there is still room for further monetary easing and warning about the risks to financial stability stemming from the uncertain trade scenario, have added negative pressure on the Euro.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.38% | 0.17% | 0.88% | 0.19% | 0.70% | 0.87% | 0.80% | |

| EUR | -0.38% | -0.22% | 0.47% | -0.19% | 0.24% | 0.40% | 0.40% | |

| GBP | -0.17% | 0.22% | 0.74% | 0.03% | 0.44% | 0.62% | 0.59% | |

| JPY | -0.88% | -0.47% | -0.74% | -0.66% | -0.17% | -0.08% | -0.07% | |

| CAD | -0.19% | 0.19% | -0.03% | 0.66% | 0.49% | 0.60% | 0.55% | |

| AUD | -0.70% | -0.24% | -0.44% | 0.17% | -0.49% | 0.07% | 0.04% | |

| NZD | -0.87% | -0.40% | -0.62% | 0.08% | -0.60% | -0.07% | -0.07% | |

| CHF | -0.80% | -0.40% | -0.59% | 0.07% | -0.55% | -0.04% | 0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

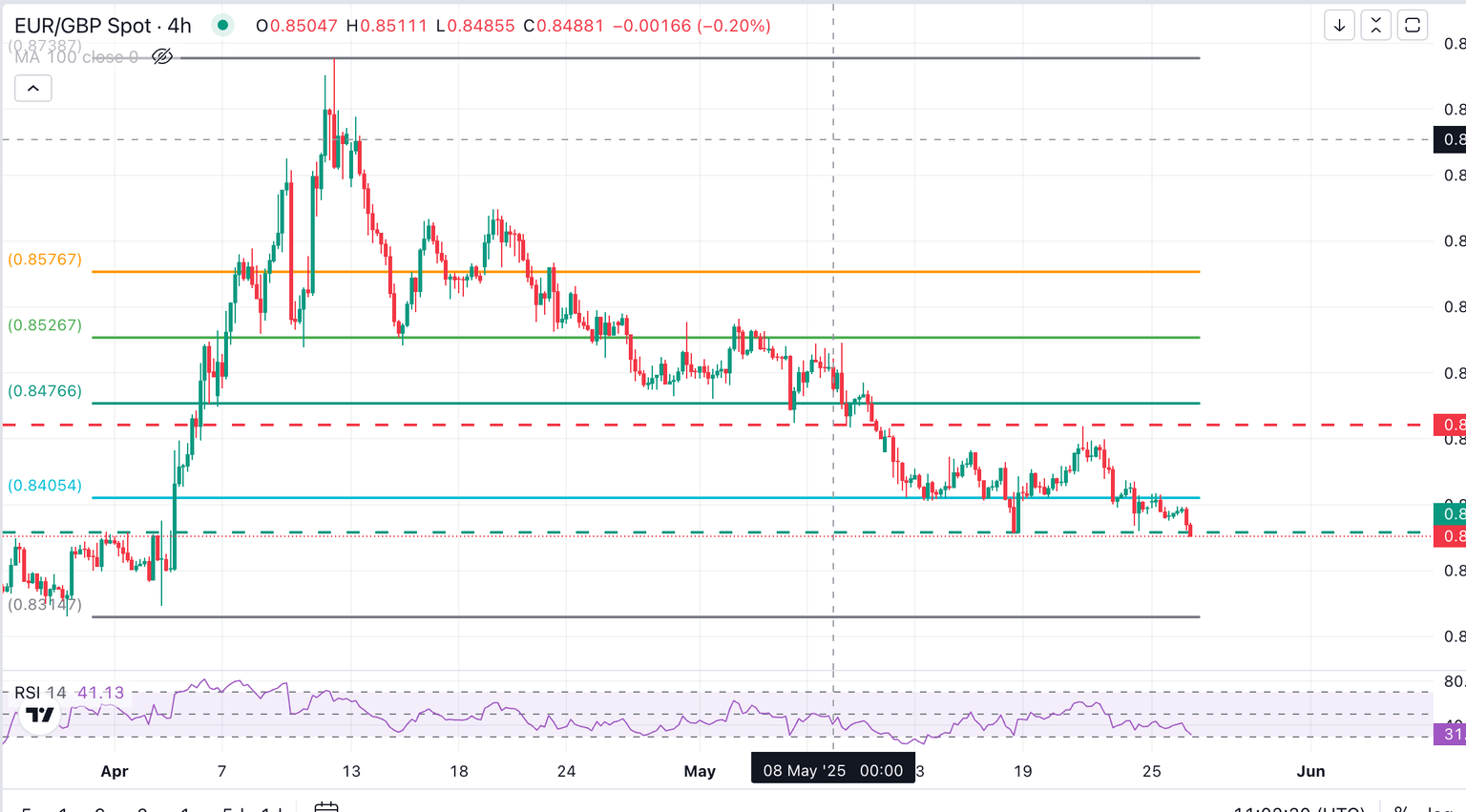

EUR/GBP Technical Analysis: Bears are pushing against 0.8380 support

The EUR/GBP remains in a bearish trend from early April highs above 0.8700. The pair broke below 0.8400 on Monday and is now testing fresh eight-week lows below 0.8380.

The next relevant resistance area remains at the late March- early April lows at 0.8325.

On the upside, the pair should return above 0.8400 and 0.8460 to break the current bearish structure.

EUR/GBP 4-hour chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.