EUR/CAD Price Analysis: Euro edges higher near 1.5600 as longer-term bias holds firm

- EUR/CAD trades near the 1.5600 zone after gaining modestly on Monday’s session.

- Bullish outlook supported by long-term trend indicators, despite short-term indecision.

- Resistance levels are forming overhead while dynamic support from EMAs remains in play.

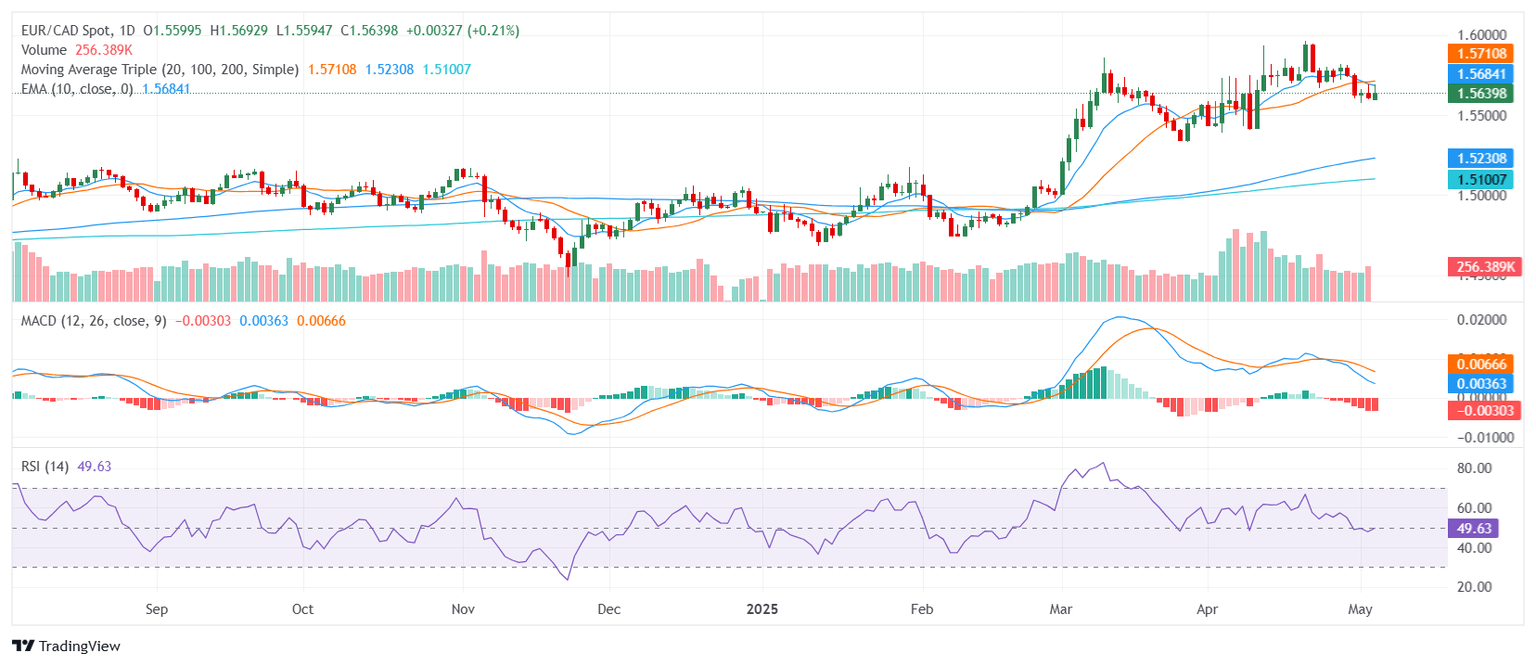

The EUR/CAD pair ticked higher on Monday, trading around the 1.5600 area after the European session. While price action remained within the middle of the daily range, the pair showed signs of underlying strength, aligning with a broader bullish structure. Momentum signals remain mixed for now, though the longer-term trend bias continues to favor the euro over the loonie.

Technically, the EUR/CAD setup holds a bullish tone despite some neutral momentum signals. The Relative Strength Index sits near 49, showing a balanced market, while the Moving Average Convergence Divergence leans bearish with a soft sell signal. The Awesome Oscillator is neutral, and the Bull Bear Power indicator suggests a slight bias toward buying pressure, offering mild confirmation of demand.

Trend indicators are more decisive. The 100-day and 200-day Simple Moving Averages sit well below current levels and continue to rise, reinforcing the broader bullish framework. Similarly, the 30-day Exponential and Simple Moving Averages offer dynamic support just under spot. On the other hand, the 20-day SMA lies slightly above price and may act as initial resistance until momentum resumes.

Support levels are noted at 1.5638, 1.5633, and 1.5595. Resistance stands at 1.5675, 1.5676, and 1.5686. A break through the resistance zone could confirm continuation of the longer-term uptrend, while failure to hold support may result in a short-term pause or retracement.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.