Emini S&P September new all time high at 6,508.75

- Emini S&P SEPTEMBER new all time high at 6508.75

Last session high & low were: 6462 - 6508.75 - Emini Nasdaq September new all time high at 24068

Last session high & low were: 23734- 23963. - Emini Dow Jones jumps to 45340

Last session high & low for the last session were: 44770 - 45371.

Emini S&P September futures

- Emini S&P can target 6488/90 (hit) & 6516/20.

- A break above 6525 can target 6550/6555.

- First support at 6465/6460 & we made a low for the day exactly here on Friday.

- Today, longs need stops below 6455.

- Very strong support at 6445/6435 & longs need stops below 6425.

Nasdaq September futures

- Emini Nasdaq break above 23800/23845 targets 23960/990 (hit) then 24150/200 (almost there!).

- Above 24240 look for 24400.

- We made a low for the day exactly at an excellent buying opportunity at 23790/740 on Friday & longs need stops below 23650 on Monday.

- Just be aware that a break below 23650 risks a slide to 23300/260

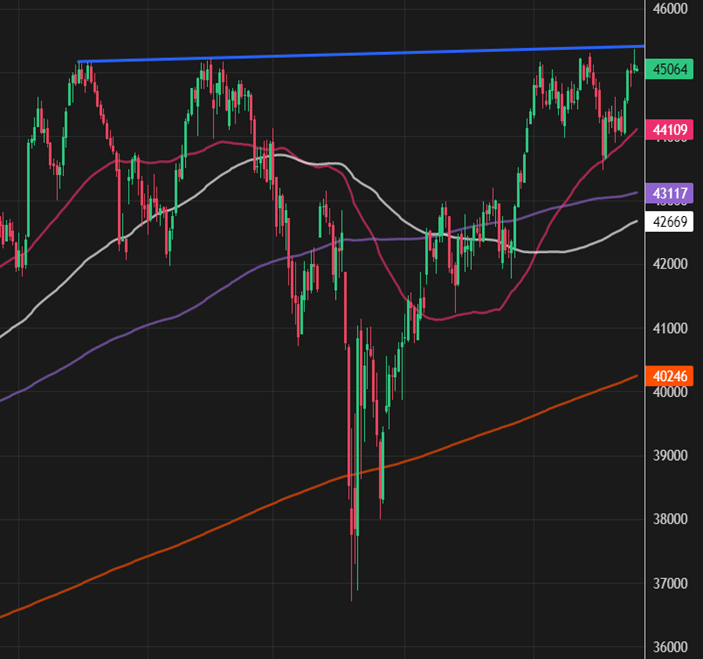

Emini Dow Jones September futures

- Emini Dow Jones made a new all time high at 45371, just below the longer term trend line at 45400/45450.

- Obviously we need a daily close above here any day this week for a new buy signal.

- Failure to beat 45400/45450 risks a slide to 45070 (would you believe this was the exact low after the test of the trend line) & even 44800/750 is possible.

Author

Jason Sen

DayTradeIdeas.co.uk