Elliott Wave view: Amazon (AMZN) should bounce before downside resumes [Video]

![Elliott Wave view: Amazon (AMZN) should bounce before downside resumes [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/ApparelDurables/pexels-waldemar-brandt-2129970-637435311762700054_XtraLarge.jpg)

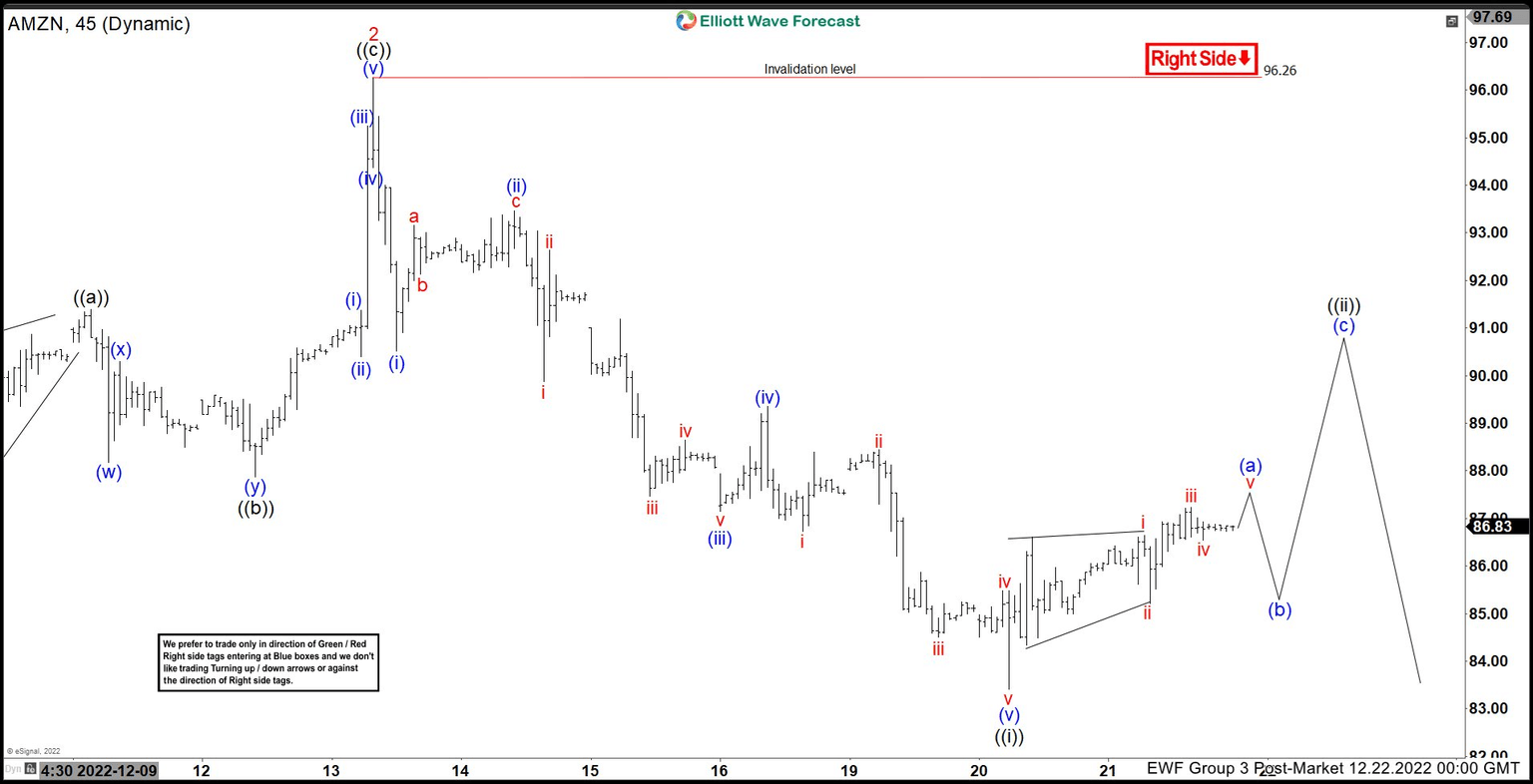

Short term Elliott wave View in Amazon (ticker; AMZN) suggests the decline from 12.13.2022 peak in 45 min chart, was clear 5 swings impulse lower, which ended ((i)) as the part of wave 3. The current sequence lower is the part of (3) of ((A)) in higher degree started from 11.15.2022 peak. It already confirms lower low in daily, calling for further downside to continue below 12.13.2022 peak. Below wave 2 peak of 96.25, it placed (i) at 90.52 low and (ii) at 93.46 high. Later, it resumes lower to finish (iii) at 87.15 low and (iv) at 89.35 high. Wave (iv) corrected 0.382 Fibonacci retracement against (iii). Below there, finally it ended (v) as ((i)) at 83.41 low with clear 5 internal subdivisions on 12.20.2022 low. Currently, it favors a bounce in ((ii)) in zigzag correction.

AMZN showing a clear 5 swings lower in ((i)) and it expecting to bounce in ((ii)) correction in 3 or 7 swings, which ideally should fail below 96.25 high of wave 2 to see further downside in wave ((iii)) of 3. It favors higher in (a) leg and expect a minor upside to finish (a) before starts correcting in (b) wave. Ideally, it expects wave (b) to hold above 83.41 low to see another leg higher in (c) to finish ((ii)) before turning down. It expects to rally in 3 or 7 swings, which should find sellers for the further downside.

Amazon (AMZN) 45 minutes Elliott Wave chart

AMZN Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com